Climate change is a global problem that needs global solutions. As the EU raises its own climate ambition, and as long as less stringent climate policies prevail in many non-EU countries, there is a risk of so-called ‘carbon leakage'. Carbon leakage occurs when companies based in the EU move carbon-intensive production abroad to countries where less stringent climate policies are in place than in the EU, or when EU products get replaced by more carbon-intensive imports.

CBAM

The EU’s Carbon Border Adjustment Mechanism (CBAM) is the EU's tool to put a fair price on the carbon emitted during the production of carbon intensive goods that are entering the EU, and to encourage cleaner industrial production in non-EU countries.

By confirming that a price has been paid for the embedded carbon emissions generated in the production of certain goods imported into the EU, the CBAM will ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU's climate objectives are not undermined. The CBAM is designed to be compatible with WTO-rules.

CBAM will apply in its definitive regime from 2026, while the current transitional phase lasts between 2023 and 2025. This gradual introduction of the CBAM is aligned with the phase-out of the allocation of free allowances under the EU Emissions Trading System (ETS) to support the decarbonisation of EU industry.

Latest developments

The Commission is pleased to announce that the application process to become an authorised CBAM declarant will launch on 31 March 2025 in the CBAM registry.

The launch will allow importers and indirect customs representatives to apply for the status of authorised CBAM declarant.

Guidance detailing the authorisation process is available in the dedicated section “Authorisation Management Module”.

The Commission encourages the competent authorities to advise importers who expect to exceed the de minimis threshold for the import of CBAM goods to apply for an authorisation as soon as possible.

- Read the news Commission Implementing Regulation as regards the conditions and procedures related to the status of authorised CBAM declarant

- Implementing regulation

CBAM simplification package: As part of the first Omnibus package on 26 February 2025, the Commission proposed a set of changes to simplify CBAM and cut red tape.

- Firstly, we propose to simplify CBAM for small CBAM importers, by introducing a new CBAM de minimis threshold exemption of 50 tonnes mass. This would allow us to keep around 99% of emissions still in the CBAM scope, while exempting around 90% of the importers.

- For those importers who expect to remain in the CBAM scope, the proposed changes will also facilitate compliance with CBAM obligations. For instance, we propose to simplify the authorisation of declarants, the calculation of emissions, and the management of CBAM financial liability.

- This will be coupled with measures making CBAM more effective, by strengthening anti-abuse provisions and developing a joint anti-circumvention strategy together with national authorities.

More information on the Commission proposal

CBAM definitive regime (from 2026)

EU importers of goods covered by CBAM will register with national authorities where they can also buy CBAM certificates. The price of the certificates will be calculated depending on the weekly average auction price of EU ETS allowances expressed in €/tonne of CO2 emitted.

EU importers will declare the emissions embedded in their imports and surrender the corresponding number of certificates each year.

If importers can prove that a carbon price has already been paid during the production of the imported goods, the corresponding amount can be deducted.

CBAM transitional phase (2023 – 2025)

On 1 October 2023, the CBAM entered into application in its transitional phase, with the first reporting period for importers ending 31 January 2024. The gradual phasing in of CBAM allows for a careful, predictable and proportionate transition for EU and non-EU businesses, as well as for public authorities.

The CBAM will initially apply to imports of certain goods and selected precursors whose production is carbon intensive and at most significant risk of carbon leakage: cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. With this enlarged scope, CBAM will eventually – when fully phased in – capture more than 50% of the emissions in ETS covered sectors. The objective of the transitional period is to serve as a pilot and learning period for all stakeholders (importers, producers and authorities) and to collect useful information on embedded emissions to refine the methodology for the definitive period.

During this period, importers of goods in the scope of the new rules will only have to report greenhouse gas emissions (GHG) embedded in their imports (direct and indirect emissions), without the need to buy and surrender certificates. Indirect emissions will be covered in the scope after the transitional period for some sectors (cement and fertilisers), on the basis of a defined methodology outlined in the Implementing Regulation published on 17 August 2023 and its accompanying guidance.

The Implementing Regulation on reporting requirements and methodology provides for some flexibility when it comes to the values used to calculate embedded emissions on imports during the transitional phase. Until the end of 2024, companies will have the choice of reporting in three ways: (a) full reporting according to the new methodology (EU method); (b) reporting based on an equivalent method (three options); and (c) reporting based on default reference values (only until July 2024).

As of 1 January 2025, a new portal section of the CBAM Registry allows installation operators outside the EU to upload and share their installations and emissions data with reporting declarants in a streamlined manner, instead of submitting it to each declarant separately. Find more guidance material below in the section “CBAM Registry access for non-EU installation operators”.

From early 2025, CBAM declarants will be able to apply for the ‘authorised CBAM declarant’ status via the CBAM Registry. Their application will be processed by the National Competent Authority of the EU Member State where they are established. This status will become mandatory as of 1 January 2026 for the import of CBAM goods in the EU customs territory.

The Commission will open the application process for authorisations as soon as the dedicated Implementing Act is adopted (planned in March). The Commission will then also make detailed guidance available.

CBAM does not apply to electricity generated in the exclusive economic zone (EEZ) of Member States and imported into the EU. Such electricity has “EU origin” and is thus not covered by Art. 2(1) of the CBAM Regulation. Hence, such electricity is not subject to reporting obligations during the transitional period and will not be subject to an adjustment under the CBAM rules as from 2026. Find more information in our FAQ (Question 95). In that context, there is no obligation, regarding such electricity imports, to apply for the status of authorised CBAM declarant, nor to access the CBAM Registry.”

A review of the CBAM's functioning during its transitional phase will be concluded before the entry into force of the definitive system. At the same time, the product scope will be reviewed to assess the feasibility of including other goods produced in sectors covered by the EU ETS in the scope of the CBAM mechanism, such as certain downstream products and those identified as suitable candidates during negotiations. The report will include a timetable setting out their inclusion by 2030.

Where to report

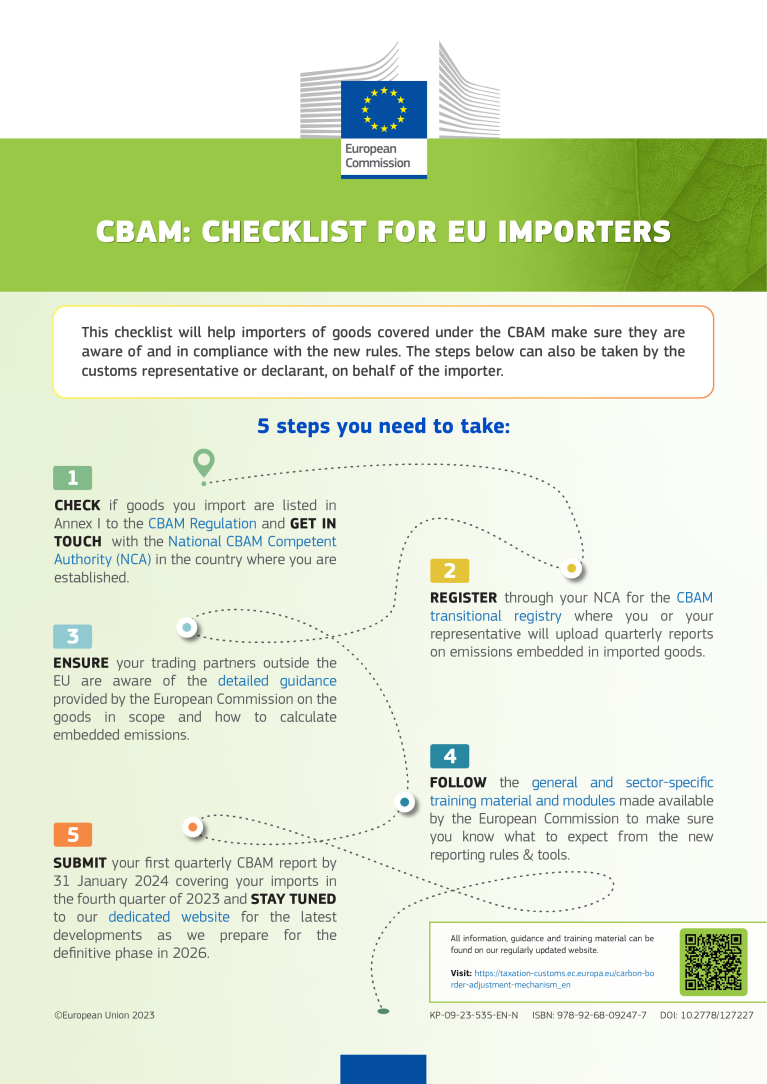

The Commission has developed the CBAM transitional registry to help importers perform and report as part of their CBAM obligations. Access to the registry should be requested through the National Competent Authority (NCA) of the Member State in which the importer is established.

CBAM Transitional Registry – Link for importers

The provided link is accessible solely to importers who have been duly registered by the relevant National Competent Authorities.

If you haven't yet registered and you wish to access the registry, kindly reach out to the NCA of your respective Member State. Otherwise, unauthorised access to the registry is prohibited.

CBAM reporting declarants will find in the CBAM Transitional Registry User Manual an XSD file describing the full structure of the CBAM quarterly report, as well as a sample ZIP file, which may be uploaded in the Registry to fill in automatically the quarterly report’s data. For convenience, the XSD and the sample ZIP files can also be downloaded below.

In addition, the Commission has prepared a specific guidance document for declarants, which outline the functioning and step-by-step use of the “request delay” options in the CBAM Transitional Registry.

The CBAM Transitional Registry is continuously enriched with IT updates and fixes (see attachment below for the latest update).

- 1 APRIL 2025

As of March 31st, Release 1.4.1.1 is in production. The latest features are highlighted in the slide below.

- 17 JANUARY 2025

- 4 OCTOBER 2024

Quarterly Report

- 1 APRIL 2025

- 1 APRIL 2025

- 1 APRIL 2025

This XLS file can be used by CBAM Declarants to facilitate completion of the CBAM quarterly reports using XML files. The XLS file indicates which are the optional/mandatory fields and provides the pre-defined values that are allowed for specific fields.

| Course Video - Quarterly Report XML Upload Tutorial | Video available here. |

Furthermore the “Error Messages Glossary” tab is providing guidance on how the user can overcome the validation error messages displayed whenever a validation rule/condition is triggered due to an issue with the field values filled/selected by the user.

How to access the transitional registry

Access to the Transitional CBAM registry should be requested through the National Competent Authority (NCA) of the Member State in which the importer is established.

- 10 DECEMBER 2024

The recording of an info session on the CBAM Transitional Registry can be found here.

CBAM Transitional Registry Privacy Statement

To help declarants to prepare for the CBAM definitive regime, the Commission has prepared a user manual for the CBAM Registry for the CBAM Definitive phase.

Legislative Documents

Find below the links to the Official Journal of the EU for all relevant legislative documents related to CBAM.

- 17 MAY 2023

- 17 AUGUST 2023

- 17 AUGUST 2023

- 18 DECEMBER 2024

- 26 FEBRUARY 2025

- 28 MARCH 2025

Guidance

The Commission has developed a CBAM Self Assessment Tool for Importers to the EU. The tool provides importers to the EU with the possibility to get a quick overview on whether the imported goods are subject to CBAM during the transitional period, what the CBAM reporting requirements for that particular type of good are, and where to find further information.

The European Commission maintains the tool to facilitate the implementation of the CBAM during the transitional period until 31 December 2025. The goal is to keep the tool timely and accurate, and if errors are brought to our attention, we will try to correct them. However, the Commission accepts no responsibility or liability whatsoever with regards to the information provided by this tool. It cannot be guaranteed that the tool exactly reproduces the officially adopted legislation. Only the Official Journal of the European Union (the printed edition or, since 1 July 2013, the electronic edition on the EUR-Lex website) is authentic and produces legal effects.

Further information on customs obligations for importers to the EU are provided by the TARIC database.

To help stakeholders prepare for the new reporting obligations as from 1 October 2023, the European Commission has prepared written guidance documents, to help navigate the transitional period (1 October 2023 – 31 December 2025).

- 30 MAY 2024

- български(1.56 MB - PDF)

- español(1.36 MB - PDF)

- čeština(1.53 MB - PDF)

- dansk(2.52 MB - PDF)

- Deutsch(1.88 MB - PDF)

- eesti(1.61 MB - PDF)

- ελληνικά(2.12 MB - PDF)

- français(1.96 MB - PDF)

- Gaeilge(1.73 MB - PDF)

- hrvatski(1.76 MB - PDF)

- italiano(2.51 MB - PDF)

- latviešu(1.44 MB - PDF)

- lietuvių(2.02 MB - PDF)

- magyar(1.83 MB - PDF)

- Malti(1.71 MB - PDF)

- Nederlands(1.36 MB - PDF)

- polski(1.84 MB - PDF)

- português(1.33 MB - PDF)

- română(1.69 MB - PDF)

- slovenčina(1.57 MB - PDF)

- slovenščina(1.59 MB - PDF)

- suomi(1.62 MB - PDF)

- svenska(1.29 MB - PDF)

- 22 DECEMBER 2023

The Guidance document on CBAM implementation for installation operators outside the EU is also available in Arabic, Chinese, Hindi, Japanese, Korean, Turkish and Ukrainian.

- General publications

- 20 June 2024

Examples of the communication template filled in for each sector: cement, aluminium, fertilisers, hydrogen, steel (blast furnace, EAF, screws and nuts).

Course: CBAM Communication Template, Topic: en (europa.eu)

The Commission has published the default values guidance that can be used to determine embedded emissions in imported goods (except electricity) covered by the CBAM.

Support for developing countries

The European Union is committed to supporting developing countries and Least Developed Countries (LDCs) in implementing the CBAM, greening their industries, and transitioning to renewable energy sources. The EU is also committed to help those countries interested in introducing or enhancing their carbon pricing systems. The following document provides an overview of guidance and technical support offered by the EU as well as of programmes supporting the green transition in developing countries and LDCs.

Sectoral information

The Commission organised a series of online webinars, covering general features of the CBAM as well as the specifics of each sector (iron & steel, aluminium, cement, fertilisers, electricity and hydrogen). Details and recordings of all webinars are available below and on the Customs & Tax EU Learning Portal.

Information relevant to all sectors

| Info Session CBAM Transitional Registry | Webinar recording available here. |

| General CBAM Info Session in English | Webinar recording available here. |

| General CBAM Info Session in Spanish (EN subtitles available) | Webinar recording available here. |

In addition, a nano-learning module introducing CBAM for EU importers and customs declarants and third country operators has been made available. They present the purpose and aims of CBAM, and implications for importers and declarants, the main criteria for CBAM pricing, the six sectors targeted by CBAM and the roles and responsibilities within the CBAM administration system, as well as planning priorities including key milestones and explains the calculation methods and reporting requirements.

- General publications

- 3 January 2024

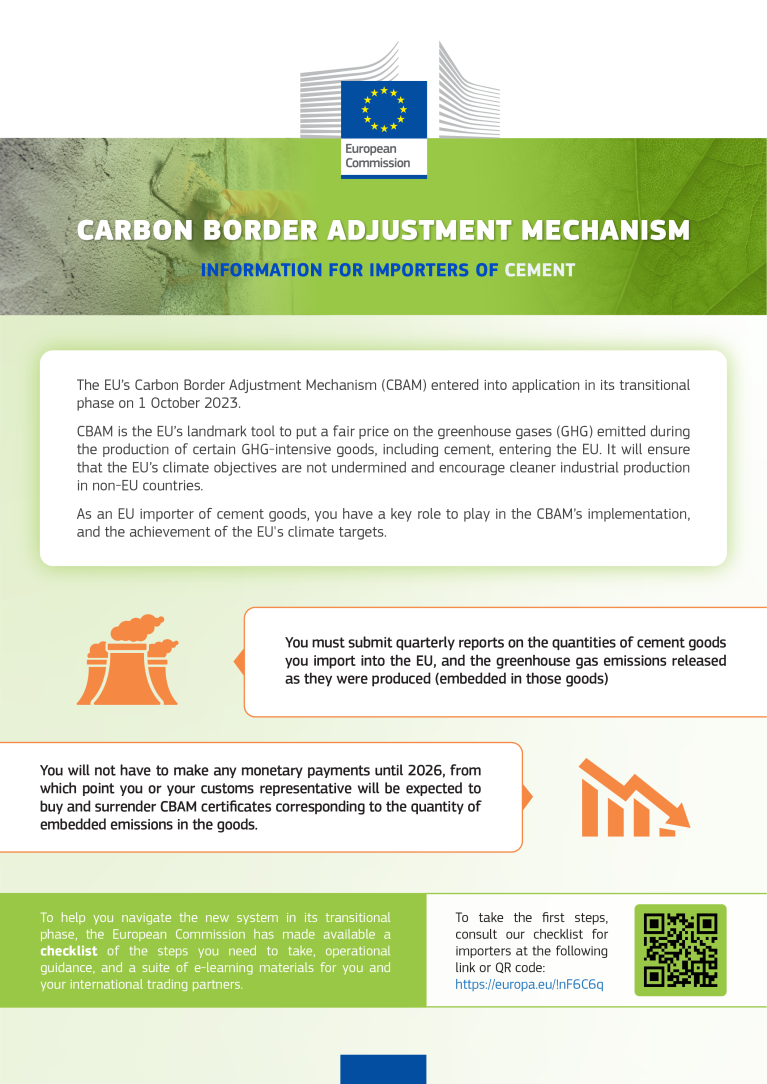

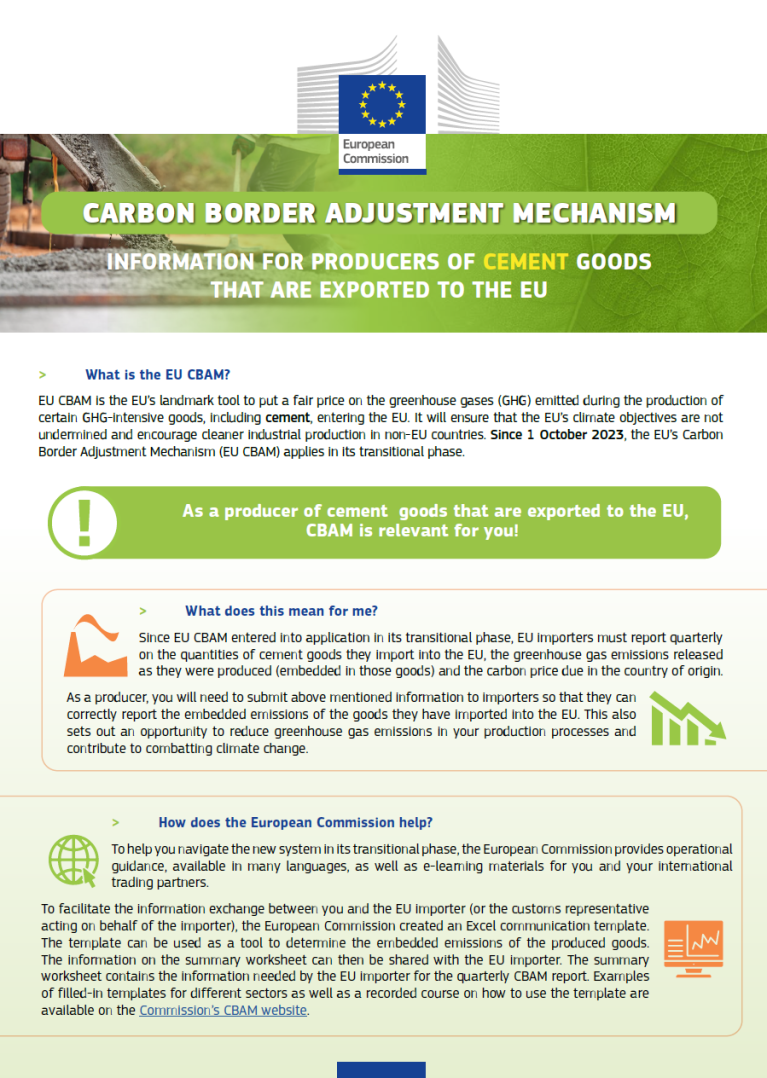

Cement

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of cement from the EU and third countries. | Webinar recording available here. |

| Info Session CBAM Declarant Portal - Cement and Aluminium sectors | Info Session recording available here. |

| e-learning module specific to the cement sector | Module available here in 10 language versions |

- General publications

- 3 January 2024

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of cement(1.01 MB - PDF)

- Information for non-EU producers of cement(1.01 MB - PDF)

- Information for non-EU producers of cement(1.01 MB - PDF)

- Information for non-EU producers of cement(792.76 KB - PDF)

- Information for non-EU producers of cement(825.61 KB - PDF)

- Information for non-EU producers of cement(1.02 MB - PDF)

- Information for non-EU producers of cement(1.02 MB - PDF)

- Information for non-EU producers of cement(903.53 KB - PDF)

The factsheet Information for non-EU producers of cement is also available soon in Hindi, Macedonian and Serbian.

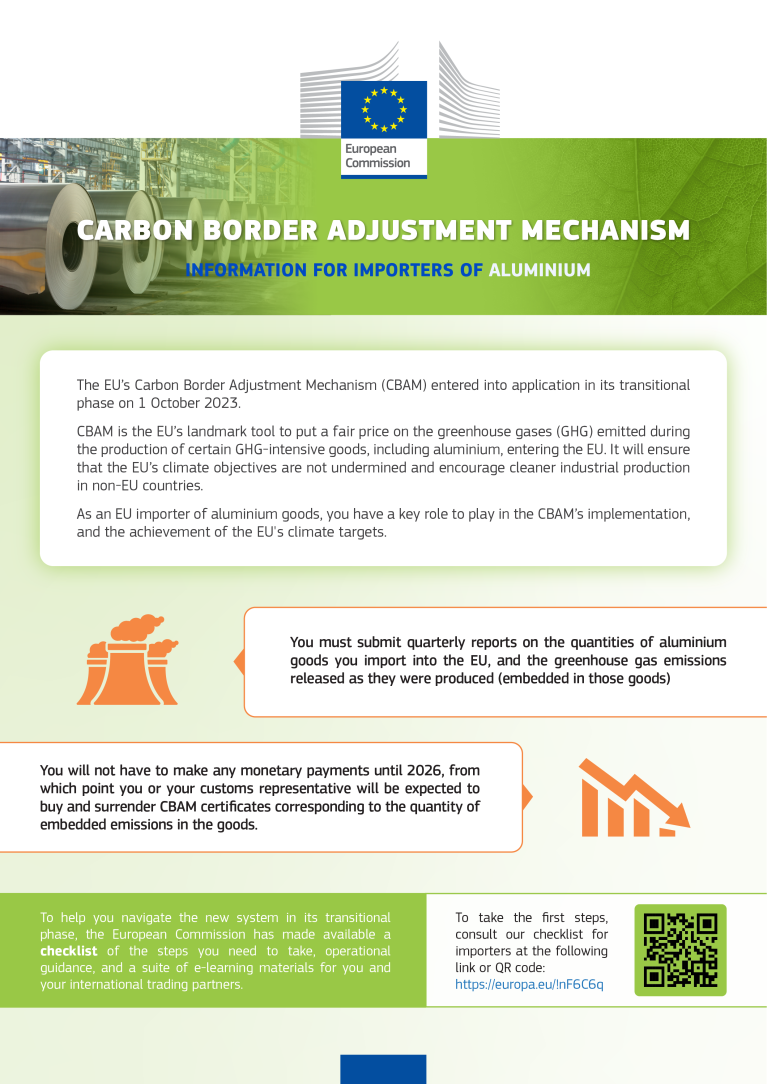

Aluminium

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of aluminium from the EU and third countries. | Webinar recording available here. |

| Info Session CBAM Declarant Portal - Cement and Aluminium sectors | Info Session recording available here. |

| e-learning module specific to the aluminium sector | Module available here. |

- General publications

- 3 January 2024

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of aluminium(1018.23 KB - PDF)

- Information for non-EU producers of aluminium(1018.48 KB - PDF)

- Information for non-EU producers of aluminium(1018.37 KB - PDF)

- Information for non-EU producers of aluminium(1.01 MB - PDF)

- Information for non-EU producers of aluminium(819.93 KB - PDF)

- Information for non-EU producers of aluminium(1018.89 KB - PDF)

- Information for non-EU producers of aluminium(1.02 MB - PDF)

- Information for non-EU producers of aluminium(898.68 KB - PDF)

The factsheet Information for non-EU producers of aluminium is also available soon in Hindi, Macedonian and Serbian.

Fertilisers

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of fertilisers from the EU and third countries. | Webinar recording available here. |

| Info Session CBAM Declarant Portal - Fertiliser and Electricity sectors | Info Session recording available here. |

| e-learning module specific to the fertiliser sector | Module available here. |

- Factsheet

- 3 January 2024

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of fertilisers(1.07 MB - PDF)

- Information for non-EU producers of fertilisers(1.07 MB - PDF)

- Information for non-EU producers of fertilisers(1.08 MB - PDF)

- Information for non-EU producers of fertilisers(1.08 MB - PDF)

- Information for non-EU producers of fertilisers(877.81 KB - PDF)

- Information for non-EU producers of fertilisers(1.08 MB - PDF)

- Information for non-EU producers of fertilisers(1.1 MB - PDF)

- Information for non-EU producers of fertilisers(953.36 KB - PDF)

The factsheet Information for non-EU producers of fertilisers is also available soon in Hindi, Macedonian and Serbian.

Iron and steel

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of iron and steel from the EU and third countries. | Webinar recording available here. |

| Info Session CBAM Declarant Portal - Hydrogen and Iron & steel sectors | Info Session recording available here. |

| e-learning module specific to the iron and steel sector | Module available here. |

- General publications

- 28 November 2023

Key points for importers of iron and steel to remember in the CBAM transitional phase as of 1 October 2023

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of iron and steel(1.08 MB - PDF)

- Information for non-EU producers of iron and steel(1.07 MB - PDF)

- Information for non-EU producers of iron and steel(1.08 MB - PDF)

- Information for non-EU producers of iron and steel(1.09 MB - PDF)

- Information for non-EU producers of iron and steel(846.69 KB - PDF)

- Information for non-EU producers of iron and steel(1.08 MB - PDF)

- Information for non-EU producers of iron and steel(1.11 MB - PDF)

- Information for non-EU producers of iron and steel(923.35 KB - PDF)

The factsheet Information for non-EU producers of iron and steel is also available soon in Hindi, Macedonian and Serbian

Hydrogen

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of hydrogen from the EU and third countries. | Webinar recording available here. |

| Info Session CBAM Declarant Portal - Hydrogen and Iron & steel sectors | Info Session recording available here. |

| e-learning module specific to the hydrogen sector | Module available here. |

- General publications

- 28 November 2023

Key points for importers of hydrogen to remember in the CBAM transitional phase as of 1 October 2023

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of hydrogen(948.83 KB - PDF)

- Information for non-EU producers of hydrogen(945.85 KB - PDF)

- Information for non-EU producers of hydrogen(951.03 KB - PDF)

- Information for non-EU producers of hydrogen(945.31 KB - PDF)

- Information for non-EU producers of hydrogen(779.64 KB - PDF)

- Information for non-EU producers of hydrogen(946.61 KB - PDF)

- Information for non-EU producers of hydrogen(954.18 KB - PDF)

- Information for non-EU producers of hydrogen(851.11 KB - PDF)

The factsheet Information for non-EU producers of hydrogen is also available soon in Hindi, Macedonian and Serbian.

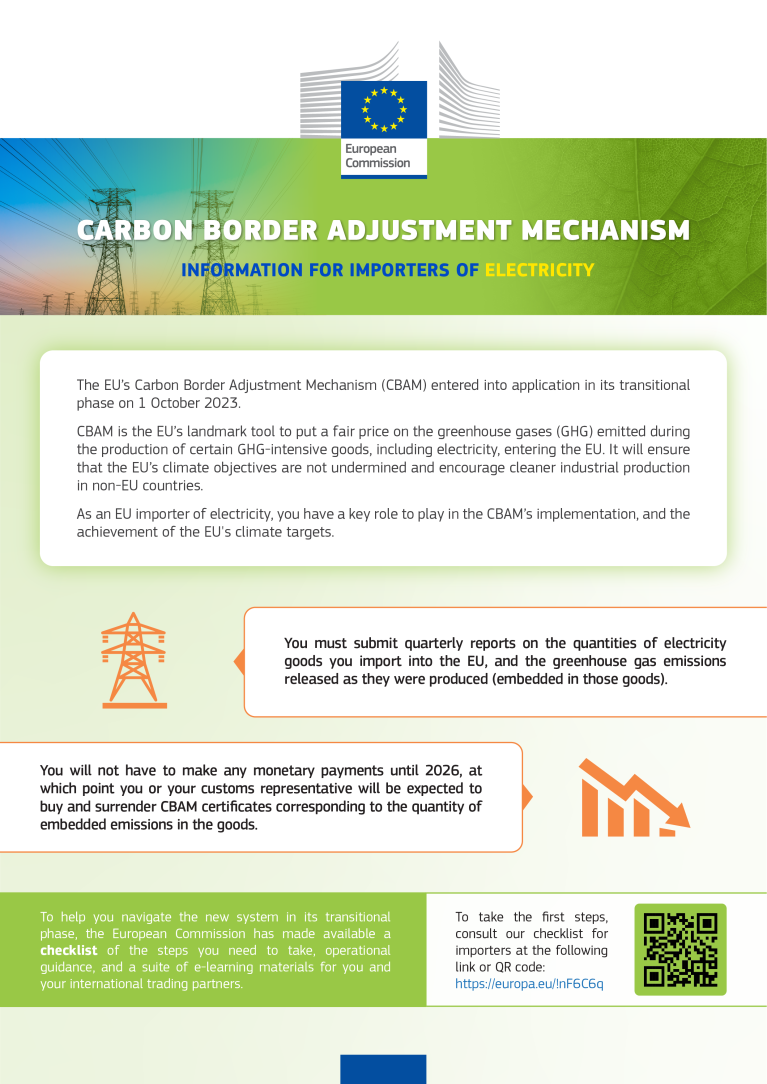

Electricity

| Webinar on rules, implications and reporting requirements for importers, exporters and producers of electricity from the EU and third countries. | Webinar recording is available here. |

| Info Session CBAM Declarant Portal - Fertiliser and Electricity sectors | Info Session recording available here. |

| e-learning module specific to the electricity sector | Module available here. |

- Factsheet

- 3 January 2024

NEW

- Factsheet

- 31 October 2024

- Information for non-EU producers of electricity(977.65 KB - PDF)

- Information for non-EU producers of electricity(971.94 KB - PDF)

- Information for non-EU producers of electricity(976.93 KB - PDF)

- Information for non-EU producers of electricity(985.26 KB - PDF)

- Information for non-EU producers of electricity(754.23 KB - PDF)

- Information for non-EU producers of electricity(977.16 KB - PDF)

- Information for non-EU producers of electricity(1002.28 KB - PDF)

- Information for non-EU producers of electricity(799.99 KB - PDF)

The factsheet Information for non-EU producers of electricity is also available soon in Hindi, Macedonian and Serbian.

Authorisation Management Module

As of 31 March 2025, a new section of the CBAM Registry allows importers and indirect customs representatives to apply for the status of authorised CBAM declarant in the Member State of establishment, which is independently from the where the goods are imported to. A list of the national competent authorities can be found on this website in the section “How to access the transitional registry”.

The section to be used is the Authorisation Management Module (AMM) (this link will be accessible on 31 March 2025). The AMM encompasses features related to CBAM Authorisations. This module facilitates the entire process, from the initial authorisation requests submitted by applicants to the consultation process between competent authorities and the Commission, culminating in a decision to grant or refuse the CBAM authorisation.

Key functionalities of the AMM include:

- Capturing all relevant authorisation information, including the required guarantees.

- Supporting the interaction between CBAM Declarants and competent authorities.

- Managing workflows between the competent authorities and the Commission, as well as back-office operations within both entities, to support the authorisation process.

CBAM-AMM Changes Since Declarant Training SfI v0.01

Below: a series of videos to assist users in navigating the system and a user manual for the declarants

| Video Name | Description |

|---|---|

| Introduction to training | This video outlines the purpose of the training, its scope and provides an overview of key CBAM AMM business concepts. |

| Consult my homepage and my user information | Guide users through the layout and main features of the homepage and profile section. |

| Consult my notifications | Familiarize users with the notifications list, explaining how to view details such as sender, subject, read/unread status, and whether a response is required. |

| Consult my submissions | Help users navigate the submissions list, understanding the key information available, such as recipient, subject, and submission date, to effectively track their submissions. |

| Set my email preference | Assist users in setting their email preferences for a specific business domain, including adding an email address, selecting a preferred language, and enabling email alerts for new notifications. |

| Access the user manual | Guide users on how to access the user manual, ensuring they can easily locate and refer to it for additional information and guidance on system functionalities. |

| Lodge an application | Guide users through the process of lodging a new application by filling in the required information across the three tabs (Stakeholders details, Activity details, and Financial and operational details). |

| Find my application and authorisation | Help users locate and consult their applications and authorisations within the system. |

| View application and authorisation details | Familiarize users with the layout and functions available in the application details page. |

| Find my drafts | Guide users in locating and managing their draft applications. |

| Withdraw an application | Show users how to withdraw an application that is in the correct status. |

| Provide adjustments to an application | Guide users in providing adjustments to an existing application. |

| Request a revocation | Show users how to request the revocation of an existing authorisation. This scenario script demonstrates accessing the revocation form, completing it, and submitting the request. |

| Withdraw a revocation request | Guide users in withdrawing a revocation request that is under processing. |

| Communicate changes which may affect the authorisation | Show users how to communicate changes that may affect their authorisation. |

| Request amendment | Guide users in requesting an amendment to specific data within their authorization. |

| Provide additional information | Show users how to provide additional information when requested by the national competent authority. |

| Exercise my right to be heard | Guide users in exercising their right to be heard regarding a decision. |

| Show users how to register a guarantee when requested | Show users how to register a guarantee when requested. |

| Adjust guarantee | Guide users in adjusting their guarantee information as requested. |

| Request guarantee release | Show users how to request the release of a guarantee associated with their authorisation. |

CBAM Registry access for non-EU installation operators

As of January 2025, new portal section of the CBAM Registry allows installation operators outside the EU to upload and share their installations and emissions data with reporting declarants in a streamlined manner, instead of submitting it to each declarant separately. The portal allows operators to ensure the confidential treatment of business-sensitive data. Reporting declarants are then able to automatically populate their CBAM reports with this emissions data in order to comply with their reporting obligation.

CBAM declarants are able to retrieve the information provided by non-EU installation operators in the Transitional Registry. A new functionality in the “Emissions” tab allows declarants to “Search in Third Country Installations registry” and access the respective installation and emissions data from there. For this to work, CBAM declarants need to share their EORI number with the supplier outside the CBAM Registry. In a future update, operators will be given the option to share their information with all interested declarants.

CBAM Registry – Link for non-EU installation operators

Please note that to become a Registered Operator, non-EU installation operators need to follow the steps outlined in the guidance material.

| Video tutorial | Description |

|---|---|

| Registration process | This video demonstrates how a new user creates a registration request, saves it and then submits it to the system. It is part of the group of training videos “CBAM Registry access for non-EU installation operators” |

| Resubmission in case of rejection of registration request | This video describes how a new user is being notified of a rejected registration request, updates and resubmits the request to the system It is part of the group of training videos “CBAM Registry access for non-EU installation operators” |

- 18 MARCH 2025

- 18 DECEMBER 2024