A common tariff of customs duties is being used on imports from outside the EU and there are no customs duties levied at the borders between EU countries. Duty on goods from outside the EU is generally paid when they first enter the EU. From then on, there are no more customs duties to pay and no more customs checks will apply - all goods circulate freely within the EU Customs Union.

The EU Customs Union is essential for the proper functioning of the single market. In practice, National customs services in all EU countries work together as one to manage the day-to-day operations of the Customs Union. The European Commission proposes the EU customs legislation and monitors its implementation.

The EU is one of the largest trading blocs in the world.

The EU is one of the largest trading blocs in the world, alongside the United States and China.

To manage the huge volume of international trade in 2023, 2 140 EU customs offices, working 24 hours a day and 365 days a year, handled the import, export and transit of more than 1 300 million items(*) - these numbers do not include the “H7” reduced declaration form used for low value consignments (<150€) and introduced in July 2021. The amount of customs duties collected (EU27) in 2023 reached EUR 28.2 billion.

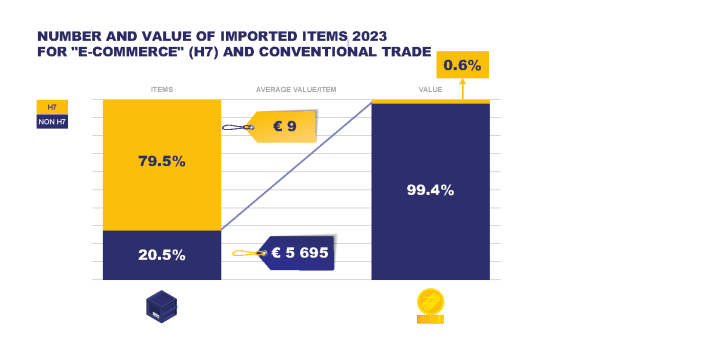

E-commerce trade has very different characteristics from more traditional trade and does not bear duties (€150 threshold) . The “H7” reduced declaration form are used for low value consignments (<€150) and were introduced in July 2021; they represent the major part of all e-Commerce consignments (more than 90%).

Source: DG Taxation and Customs Union (provisional data)

Overall in 2023, for the EU27, aggregating the data for H7 and non-H7 as total customs activity, 79% or 2.1 billion of the 2.6 billion imported items are lodged with a H7 declaration, but those declarations represent only about 0.6% of total import value.

(*) Note that one item represents one line in a customs declaration and may consist of more than one similar articles i.e. pieces of same goods.