TaxCompEU is a standardised approach to training and performance development for taxation in the EU. It comprises a guiding framework and toolset that aims to connect Human Resources (HR) processes under a pan-European, tax-specific, competence-based methodology.

As such, it has the potential to form the backbone for national HR practices as well as a common language for EU countries and the EU itself as they seek to provide prime public-sector services across the Union through a better trained, more efficient tax workforce.

TaxCompEU is currently available in 21 EU languages.

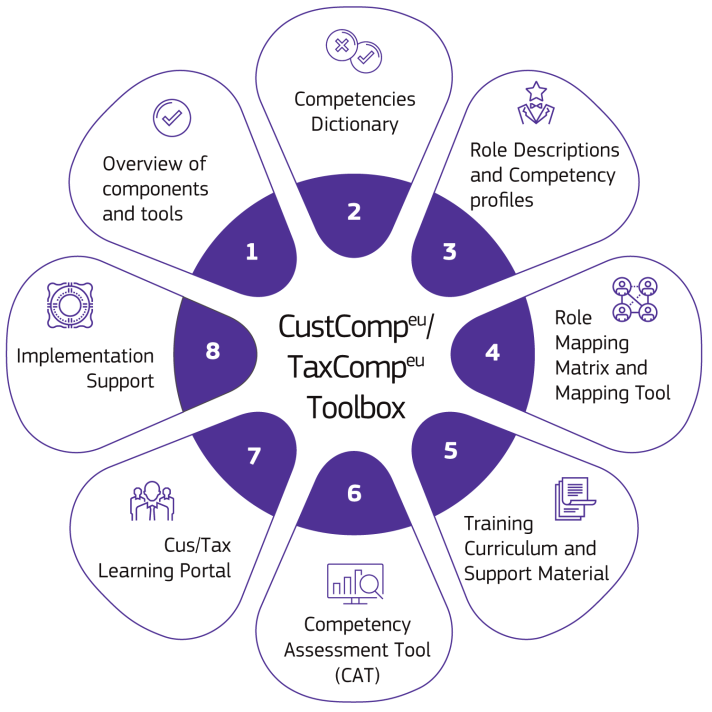

- Overview – describes the full functionality of the framework for EU Taxation

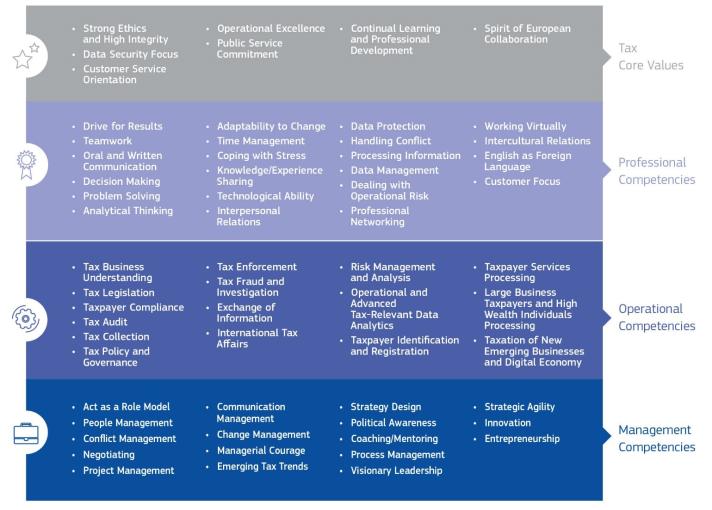

- Competence Dictionary – detailed descriptions of the Core Values, Professional, Operational and Management Competencies and Proficiency Levels

- Role Descriptions – eight documents containing scope and task descriptions per functional domain and hierarchical level, as well as a competency profile specific to each role:

- Tax Policy and Law

- Taxpayer Services

- Tax Collection

- Tax Audit

- Risk Management

- Tax Fraud and Investigation

- Supportive Functions

- Cross Functional

- Role Mapping Matrix – common tax roles in an EU Tax Administration, including role descriptions, high-level tasks per role and a competency profile specific for each role

- Training Curriculum – four documents containing:

- Overview – describes the full functionality of the training curricula

- For Professional Competencies – an extended, per-competency description of the training topics and outcomes linked to the competency

- For Operational Competencies – an extended, per-competency description of training topics and outcomes linked to the competency, best read together with the equivalent section of the TaxCompEU Competency Dictionary

- For Management Competencies – an extended, per-competency description of training topics and outcomes linked to the competency, best read together with the equivalent section of the TaxCompEU Competency Dictionary

- Competency Assessment Tool – web-based interface providing national administrations with the opportunity to assess job/role-specific competencies and perform administrational gap analyses. The CAT generates data via a three-phased process (self-assessment, supervisor assessment, assessment results). For National Tax Administration use only.

- Communication Support

- Communication Messages – major communication arguments towards leadership, HR departments and executives, employees within the tax administration and other general audiences, to help support TaxCompEU implementation initiatives

- Europa webpage – contains all relevant TaxCompeu information

- Infographics

- Brochure

- Leaflet

- National Adoption Guide