The Customs Decisions System

The European Commission and EU Member States have introduced on 2 October 2017 the first version of the Customs Decisions System (CDS) for the introduction of all new applications for customs decisions or authorisations in an electronic way.

As from 1 July 2020, a major release of this system has been deployed with full compliancy to the legal requirements, improvements and new functionalities that were developed in consultation and cooperation with the Member States. See section “What are the main new functionalities in this new release?” for more details.

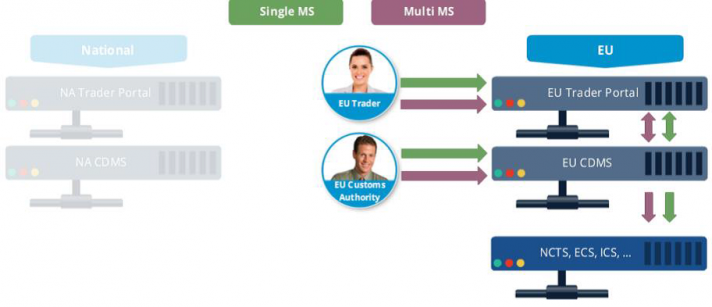

The CDS is based on an IT architecture with both national and EU common components.

- The central CDS is to be used for all applications and decisions which may have an impact in more than one Member State, and for any subsequent event which may affect the original application or decision (annulment, suspension, revocation or amendment);

- Some Member States will use the CDS also to manage their national customs decisions (i.e. which have only a national impact), whilst other Member States will deploy their national CDS.

An Economic Operator (EO) will have to access either the central or national CDS, depending on the geographical validity and the Member State involved. See the section 'Where to apply?' for more details.

A legal framework was also created to define the technical arrangements for the system which are described in the Commission Implementing Regulation (EU) 2019/1026 of 21 June 2019 on technical arrangements for developing, maintaining and employing electronic systems for the exchange of information and for the storage of such information under the Code.

How will the Customs Decisions System work?

Economic operators wishing to submit an application have to connect to the EU Trader Portal, a single electronic access point deployed at EU level for accessing the Customs Decisions System. There are plans to provide an integration into the EU Customs Trader Portal.

The EU Trader Portal uses the authentication solutions covered under the project Uniform User Management & Digital Signature (UUM&DS).

Member States may in addition offer a national portal. See section below 'Where to apply?'

Economic operators need to possess a valid EORI number and the appropriate roles assigned to access the system (customs decisions consultative profile, administrative profile, executive profile).

In order to obtain an EORI number and role, economic operators need to contact the competent authority for EORI registration in the country where they are established.

In order to facilitate the submission of an application for a large number of goods, the system facilitates the use of a mass upload, and can be find in the section with the “Relevant background material”.

Where will the Customs Decision be valid?

According to article 26 of the Union Customs Code, the decisions/authorisations can have a Union wide validity.

It is important for the applicant to define where the authorisation should be valid.

Two different possibilities exist:

1) Single Member State or national decisions will only affect and be valid in the Member State to which the application is addressed and no other Member States are involved.

2) Multi-Member States decisions potentially affect (can be valid) in several, or all, Member States.

In the system, the applicant must indicate the relevant choice in the mandatory data field "geographical validity".

- Code 1 = Application or authorisation valid in all Member States

- Code 2 = Application or authorisation limited to certain MS

- Code 3 = Application or authorisation limited to one Member State

In addition, the Member States in which the decision is intended to be valid need to be explicitly listed by the applicant.

Where to apply?

The competent Customs Authority to apply shall be in principle that of the place where the applicant's main accounts for customs purposes are held.

Member States can choose one of the different architectural approaches. Depending on the Member State and geographical validity, an Economic Operator (EO) will have to access either the EU Trader Portal or the national trader portal. Depending on the selected option, the process to obtain an authorisation will run either in the central or national CDS. The IT architecture consists of 3 different types of systems:

- Central system: the EO shall access the EU Trader Portal for all decisions;

- Central system and national system: the EO shall access the EU Trader Portal for multi Member States decisions and the national trader portal for single Member State decisions;

- Hybrid: the EO can access the EU Trader Portal or national trader portal for multi Member States decisions, and the national trader portal for single Member State decisions.

| Member States | Central system | Central system + national system | Hybrid |

| Austria | X | ||

| Belgium | X | ||

| Bulgaria | X | ||

| Croatia | X | ||

| Cyprus | X | ||

| Czech Republic | X | ||

| Denmark | X | ||

| Estonia | X | ||

| Finland | X | ||

| France | X | ||

| Germany | X | ||

| Greece | X | ||

| Hungary | X | ||

| Ireland | X | ||

| Italy | X | ||

| Latvia | X | ||

| Lithuania | X | ||

| Luxemburg | X | ||

| Malta | X | ||

| Netherlands | X | ||

| Poland | X | ||

| Portugal | X | ||

| Romania | X | ||

| Spain | X | ||

| Slovakia | X | ||

| Slovenia | X | ||

| Sweden | X | ||

| United Kingdom |

The economic operator should address any further communication or amendments of the application or decision/authorisation via the same trader portal as used for the initial application.

How are other Member States involved?

Where necessary, the Decision Taking Customs Authority (DTCA) will consult through CDS other involved Member States before issuing the decision.

In the new version of the system, the consultation mechanism has changed and is different for the 22 authorisations (see more in the next chapter).

The consultation is always mandatory for the following authorisations: CCL, ETD, RSS and TST

There is no consultation in case of the following authorisations: ACE, ACR, ACT and SSE

For the other authorisations, the consultation is optional/mandatory(*) for which the consultation procedure is organized in two types:

a) Type I: where the consultation refers to the fulfillment of the necessary conditions and criteria for taking a favorable decision (ACP, AWB, CVA, DPO, EIR, ETD*, RSS*, SAS, SDE, TRD);

b) Type II: where the consultation involves the communication of the draft authorization to the consulted MS (CCL*, CGU, CW, EUS, IPO, OPO, TEA, TST*).

The maximum deadline for consultation and deadline to reach an agreement is different per type of authorisation and can be consulted in the training documentation set or user guides.

Which types of applications or authorisations are managed in CDS

The CDS is handling 22 types of applications/authorisations. All other applications for a customs decision are not in scope of the CDS and must be made outside the system.

Data related to the applications and authorisations listed above is processed in CDS and used by officers from the competent national customs authorities for the handling of the application and decision taking process, and also in the management of the lifecycle of the decisions/authorisations. Data is also used by the economic operators (and their representatives) to submit the application, to lodge additional info and to check the status of his application.

What are the main new functionalities in this new release?

The consultation mechanism (see “How are other Member States involved?”) has changed in the system, and better aligns with the functionality of the different types of authorisations.

Another change is the behaviour of the system and the process flow for a consultation and RTBH in case of a minor amendment, the consultation when the geographical validity is amended, and in case the amendment is started by the customs authorities.

Other main changes include: the verification of the EORI’s representative is now available in the system, a restriction in the port of calls for an application/authorisation and the possibility to justify a re-assessment.

How I can access the system?

EO and their delegated users having one valid account for accessing National Customs application in one MS can request, in the MS Customs office responsible for managing Economic Operators, a user account to obtain the required authorisation roles for accessing the EU trader Portal of CDS.

The access to the EU Trader Portal of CDS is validated and managed through the Uniform User Management and Digital Signature System (UUM&DS).

The UUM&DS system implements identity federation between the Commission and all Member States' identity and access management systems for the purposes of providing secure authorised access to the EU Customs electronic systems for EU Economic operators and persons other than the economic operators.

The UUM&DS system can also be used by Economic Operators for managing the authorisation assignments (delegations) to their delegated users such as:

- First level delegation: customs representatives for the economic operators (CR) or employees of the economic operators (EMPL)

- Second level delegation: employee of a customs representative for an economic operator

for the Member States that have selected to use the central delegation service. The following table summarizes the delegation type and the identity and access management (IAM) type per Member State:

| Member State | Delegation Type | IAM of type |

| Austria | Local | A |

| Belgium | Central | A |

| Bulgaria | Local | A |

| Croatia | Local | C |

| Cyprus | Central | C |

| Czech Republic | Central | D |

| Denmark | Local | C |

| Estonia | Local | A |

| Finland | Local | B |

| France | Local | A |

| Germany | Central | A |

| Greece | Central | B |

| Hungary | Local | A |

| Ireland | Central | A |

| Italy | Local | A |

| Latvia | Local | A |

| Lithuania | Local | A |

| Luxembourg | Central | D |

| Malta | Central | D |

| Netherlands | Local | C |

| Poland | Local | C |

| Portugal | Central | D |

| Romania | Central | D |

| Spain | Local | A |

| Slovakia | Local | A |

| Slovenia | Local | A |

| Sweden | No delegation | A |

| Northern Ireland | Central | D |

Type A: MS IAM in the Customs Domain is one consolidated system for the authentication and authorisation of users that can be directly interfaced with the UUM&DS system.

Type B: MS IAM in the Customs Domain consists of two systems, one for the authentication and another for the provision of additional attributes. UUM&DS requests and retrieves authentication and authorisation information from one system in the MS which the Single Point Of Contact (SPOC) with UUM&DS.

Type C: MS IAM in the Customs Domain consists of multiple IAMs for the authentication and the authorisation of users. MS shall provide a unified IAM with a common authentication portal in order to interface with the UUM&DS system.

Type D: The MS has no IAM that can be federated with UUM&DS. Consequently, it will provision identities and authorisations into the central UUM&DS system.

What is in for me?

Customs procedures in the Customs Union have been modernised to promote and generate economic growth and jobs, through the definition of EU harmonised rules and requirements (including process and data requirements) and through the gradual implementation and integration of trans-European IT systems.

The CDS is an essential instrument to enable the processing and management of applications and decisions with a Union-wide validity. The authorisations, when granted, will provide Economic Operators with simplifications to conduct their business across the EU. Together with the EU Trader Portal, it offers an appropriate level playing field among all economic operators in the EU, big and small, and make sure that EU businesses remain competitive to withstand globalisation.

CDS will also support the Member States' customs authorities in the proper management of applications and decisions and in the protection of financial interests as it enables automated checks in the declaration systems.

Relevant background material

To connect with the systems, please use one of the supported internet browsers: Microsoft Edge, Google Chrome or Mozilla Firefox.

Online addresses to the systems:

- EU Trader Portal system – where the Economic Operators in Member States will register their applications; the authentication being provided by UUM&DS

- Central Uniform User Management and Digital Signature System – UUM&DS – where Member States traders may manage authorisation assignments (delegations)

- Central Data Dissemination System for Economic Operators data (DDS2-EO) – where Member States traders may check the validity of their Customs Decisions authorisation

Documentation about the systems:

- Business User Guide: describing the general functioning of the system

- Downloadбългарски

- Downloadespañol

- Downloadčeština

- Downloaddansk

- DownloadDeutsch

- Downloadeesti

- Downloadελληνικά

- Downloadfrançais

- Downloadhrvatski

- Downloaditaliano

- Downloadlatviešu

- Downloadlietuvių

- Downloadmagyar

- DownloadMalti

- DownloadNederlands

- Downloadpolski

- Downloadportuguês

- Downloadromână

- Downloadslovenčina

- Downloadslovenščina

- Downloadsuomi

- Downloadsvenska

- End-User Guide: providing detailed explanation on the use of specific fields, rules and conditions in the system

- UUM&DS Economic Operators Manual:

- Trader Portal User Manual

- Customs Decisions System – eLearning module

- CDS Leaflet:

- CDS Course Takeaways:

- National Service Desks Contact Points:

- Templates for mass upload goods in applications and authorisations – are now available in the system itself. Please do not use the templates from version 1.

- Frequently Asked Questions: practical cases offering a solution or workaround for questions asked by a user (either Economic Operator, representative or Customs Officer)

- Legal notice containing a disclaimer, a copyright notice and rules on both personal data protection and the use of the EU emblem by third parties