As part of the EU's continued commitment to promoting tax transparency and fair taxation globally, Member States have updated the EU list of non-cooperative jurisdictions for tax purposes. This update is a significant milestone in the EU's efforts to tackle tax fraud, evasion, and avoidance worldwide.

A Constructive Dialogue with International Partners

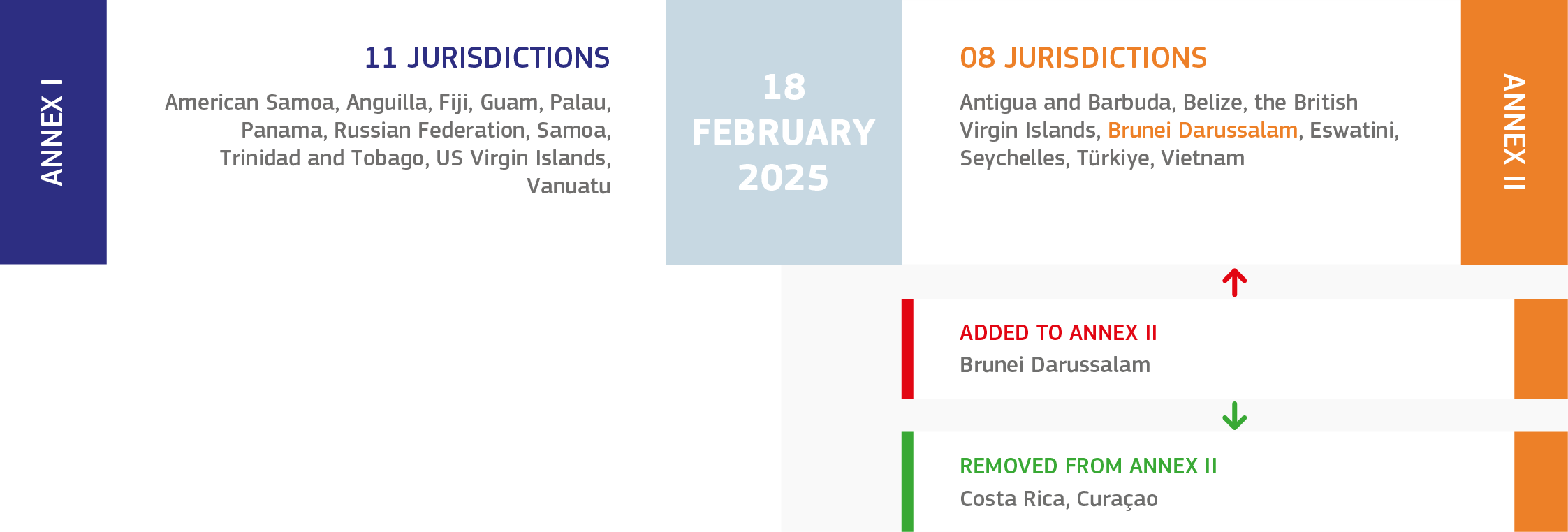

The updated list demonstrates the positive effects of constructive dialogue and cooperation between the EU and its international partners. Notably, no new jurisdictions were added to the list of non-cooperative jurisdictions (Annex I), which currently comprises 11 third-country jurisdictions: American Samoa, Anguilla, Fiji, Guam, Palau, Panama, the Russian Federation, Samoa, Trinidad & Tobago, US Virgin Islands, and Vanuatu. Annex I is revised to reflect efforts already undertaken by some of these jurisdictions to address outstanding areas of concern and improve their tax governance frameworks.

Jurisdictions with Pending Commitments

In addition to the jurisdictions listed in Annex I, 8 jurisdictions have made commitments to improve their tax governance frameworks, which are registered in the list of cooperative jurisdictions (Annex II). These jurisdictions include Antigua and Barbuda, Belize, British Virgin Islands, Brunei Darussalam, Eswatini, Seychelles, Türkiye, and Viet Nam. The EU will closely monitor these commitments to ensure they are implemented within the available timeframe.

The EU Listing Process: A Framework for Dialogue and Cooperation

The EU listing process provides a framework for dialogue, outreach, and cooperation between the EU and international partners on important tax issues. This process is based on a thorough screening, assessment, and monitoring of jurisdictions according to objective, clear, and internationally accepted criteria on tax transparency, fair taxation, and the implementation of anti-BEPS minimum standards.

Supporting Third Countries in Strengthening Their Tax Governance

As part of the EU listing process, the Commission provides considerable support to third countries in strengthening their tools against tax abuse, as well as technical assistance to those that need it. The Commission is also working with Member States to further strengthen the EU listing criteria to ensure greater tax transparency and effective and fair taxation.

A Dynamic and Adaptive Approach

The EU list is updated twice a year to reflect changes in jurisdictions' tax policies and cooperation levels. This ensures that the list remains relevant and accurate, allowing the EU to adapt its approach to the evolving tax landscape. Also, the methodology for revising the geographical scope of the EU list and the same criteria of the EU list are under constant review, to make sure that the EU list remains effective and credible over time.

By providing a framework for dialogue and cooperation, supporting third countries in strengthening their tax governance, and regularly updating the list, the EU is demonstrating its commitment to tackling tax fraud, evasion, and avoidance worldwide.

Background information

Common EU list of third country jurisdictions for tax purposes

Details

- Publication date

- 18 February 2025

- Author

- Directorate-General for Taxation and Customs Union