In the EU, if you want customs to be active in protecting your rights at the EU border by detaining goods suspected of infringing Intellectual Property Rights (IPR), you must first file a customs application for action (AFA).

Article 5(6) of Regulation (EU) No 608/2013 regarding customs enforcement of IPR foresees that “Where computerized systems are available for the purpose of receiving and processing applications, applications as well as attachments shall be submitted using electronic data-processing techniques.”

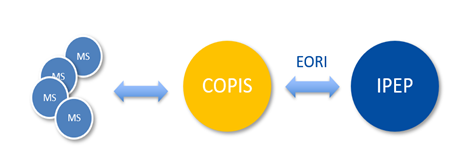

Since 13 December 2021, Right holders and their representatives can use IP Enforcement Portal (IPEP) or national portals in place, which are fully integrated with the anti-COunterfeit and anti-Piracy Information System (COPIS) to submit electronic AFAs (eAFAs) to customs.

COPIS remains the central EU database, essential to ensure a proper cooperation between customs authorities and the Commission in the framework of customs enforcement of IPR. It allows the exchange of information relating to decisions on AFAs and to customs detentions of goods suspected of infringing an IPR.

IPEP is the EU platform that assists IPR owners in filing and managing AFAs and dealing with related IPR enforcement matters in all 27 Member States, with an alternative in 3 Member States which have developed their own trader portals (Germany, Italy and Spain).

IP right holders who have not yet started using trader portals to record their AFAs shall do so in the upcoming months.

We are now at the end of the transition phase where paper AFAs are still accepted by Member States. In 2024, this phase will end and no more paper AFAs will be accepted afterwards. The precise date in 2024 will be communicated later, a few months before it becomes mandatory to lodge eAFAs.

How can rights holders access the IP Enforcement Portal?

To file and manage AFAs in IPEP, rights holders or their legal representatives can access IPEP using either their IPEP credentials or by using their EU Customs Trader Portal (UUM/DS) credentials.

To request an account in IPEP, rights holders need to indicate here a valid EU trademark or design on the basis of which the account is requested.

Find here more information on how to access IPEP.

Find more information regarding the national portals here after:

What about legal representatives?

Legal representatives can also request an account on behalf of their right holders.

They can access the tool through a ‘legal representative’ account in IPEP created through a client’s (rights holder’s) account. A legal representative can also manage multiple right holders’ accounts (please find here detailed instructions for legal representatives).

Overall AFA Management through IPEP

With the mandatory eAFA, right holders will be able to manage their AFAs through IPEP, which is connected to COPIS where the information is stored

Once they have logged into their IPEP account, through the EORI numbers entered they will be able to see their AFAs which will be retrieved from COPIS.

To help the smooth transition of the IPEP community, the landing page of the IP Enforcement Portal has been updated to include an eAFA toolkit with accompanying training material. For any enquiries, please feel free to contact the IPEP team on ipenforcementportal euipo [dot] europa [dot] eu (ipenforcementportal[at]euipo[dot]europa[dot]eu).

euipo [dot] europa [dot] eu (ipenforcementportal[at]euipo[dot]europa[dot]eu).

Details

- Publication date

- 16 October 2023

- Author

- Directorate-General for Taxation and Customs Union