A business process coordinates the behaviour of people, information, and systems

to produce outcomes in support of the business strategy.

The EU Customs Business Process Models (EU Customs BPM) were created in 2010 upon request of the Member States' customs authorities and the trade community in order to facilitate the reading of the newly proposed legal provisions. It aims at a better understanding of the "TO BE" situation and the impact of the changes on the practical customs processes and procedures. A EU Customs BPM publication supporting the UCC was prepared with support of customs experts from the Member States. (disclaimer: the information contained in this publication cannot be considered as legally binding).

To access the models, please use this link, and enter the following information to log into the system:

- User: ucc4pub

- Passwd: UCC4public

The EU Customs BPM and its related activities are particularly useful as they show the legal provisions in a visual, understandable and integrated way (combining provisions from UCC, UCC DA and UCC IA).

As such, they contribute to a a harmonised and correct implementation of the UCC legislation and the processes defined.

EU Customs BPM Methodology

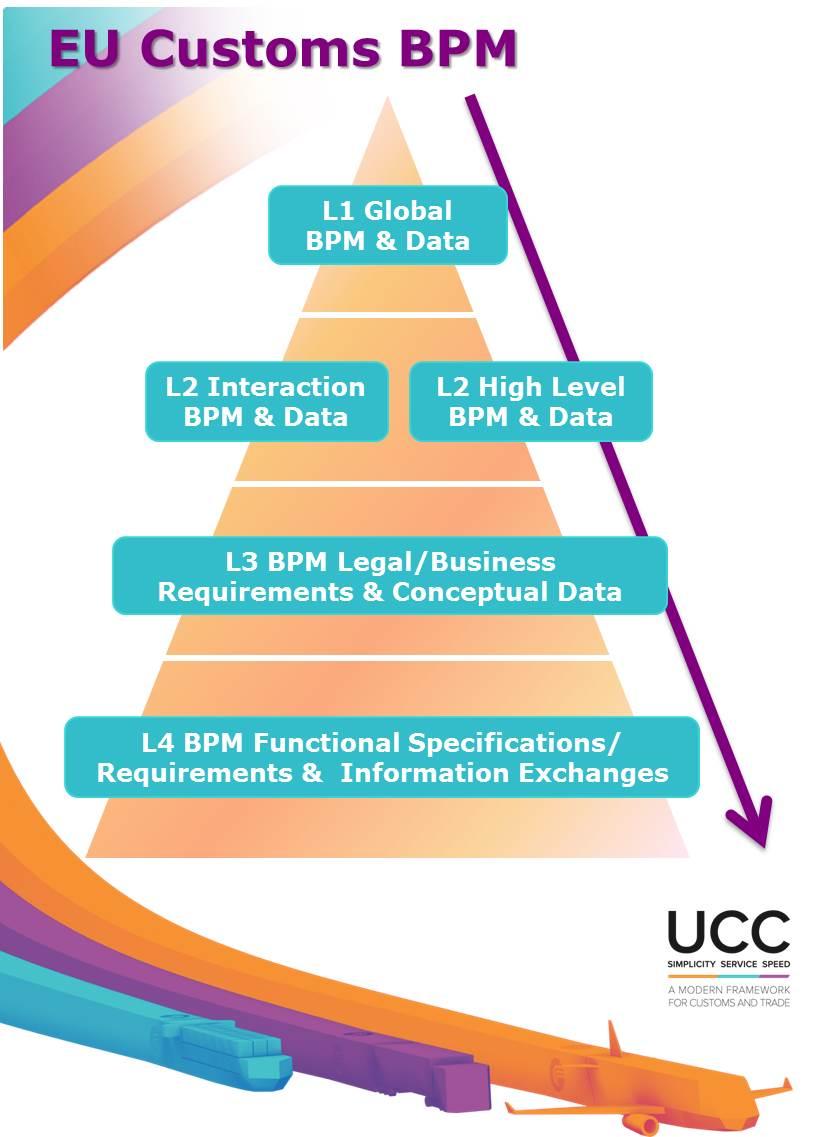

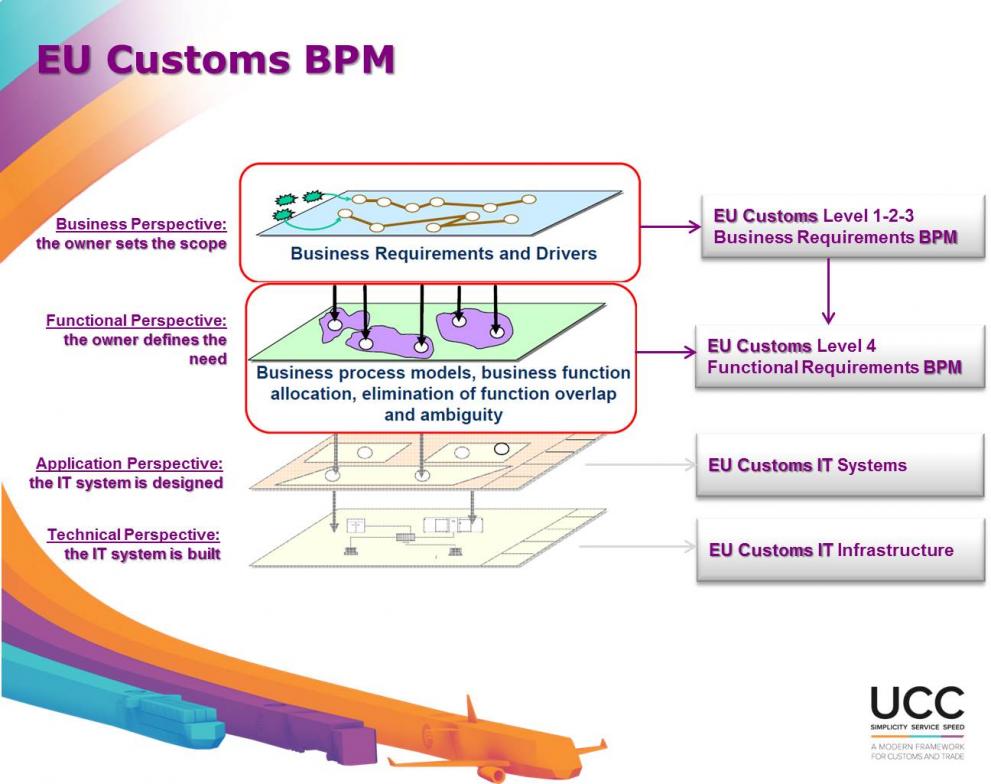

Besides the design and creation of the EU Customs BPM, a methodology has been established which defines the levelling approach, modelling methods and tools, and guidance. Levelling refers to different levels / layers of abstraction where business processes are provided in a hierarchical format.

This hierarchical modelling will enable the development of a holistic view of the customs organisation that can be presented to, and understood by, a wider audience.

| EU Customs BPM provides different views dependent on level of detail that is relevant for the reader: Level 1 and Level 2 BPM give an overview of all customs business domains (core processes and enabling processes) and global business data and define the interaction between them; Level 2 and Level 3 BPM give an overview of the process steps and tasks (legal requirements) as defined by the UCC legislation. The reader could best start from the overall EU Customs Global BPM (Level 1) and then zoom into the next, more detailed Level 2-3 BPMs, which include also specific cross references to the different parts of the UCC legislation. More information on the modelling methods and conventions, such as the modelling 'language' (e.g. BPMN and other notations), the type of diagrams, the selected set of modelling symbols, and the meaning of each symbol is included in the posters BPM Notation (BPMN) and Value Added Chain Diagram (VACD). |

In addition, the documents EU Customs BPM Approach and EU Customs BPM User Guide are available to support the use and understanding of the EU Customs BPM.

EU Customs BPM: From a legal to a technical support tool

| As business process modelling is an approach that embraces business and IT together in an integrated way, the levelling approach established at DG TAXUD contains even a more detailed layer, a so-called Level 4 BPM. This level aims to translate the business or legal requirements into functional or system requirements as a basis for the development of technical specifications for the related IT systems. The Level 4 BPM uses the EU Customs Data Model as source information for the detailed system requirements. The work on this level is currently ongoing with the Member States' experts for the different projects of the UCC Work Programme. |