E-commerce trade has very different characteristics from more traditional trade and does not bear duties (€150 threshold) . The “H7” reduced declaration form are used for low value consignments (<€150) and were introduced in July 2021; they represent the major part of all e-Commerce consignments (more than 90%).

Ever increasing part of customs activity

Source: DG Taxation and Customs Union

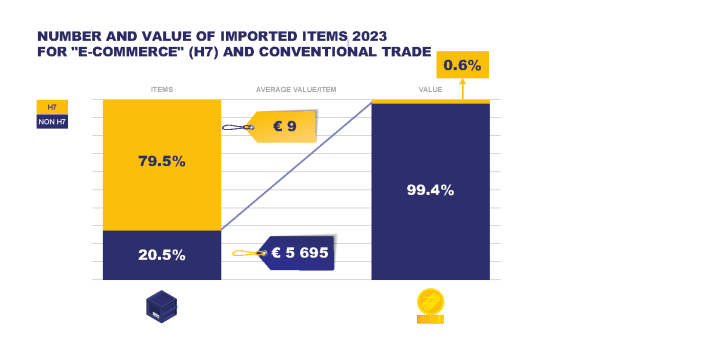

Overall in 2023, for the EU27, aggregating the data for H7 and non-H7 as total customs activity, 79% or 2.1 billion of the 2.6 billion imported items are lodged with a H7 declaration, but those declarations represent only about 0.6% of total import value.

Most e-commerce products are exported from China

Products by CN code