First proposed by the Commission in January 2016, the EU list of non-cooperative third countries has proven a true success in promoting fair taxation worldwide. Since the first list was adopted by Member States in the Council in December 2017, many countries have taken concrete measures to comply with tax good governance standards. With each update of the list, we see that this clear, transparent and fair process is delivering real change. This list is part of the EU's work to fight tax evasion and avoidance and aims to create a stronger deterrent for countries that consistently refuse to play fair on tax matters.

The EU List

The countries in the list below are those that refused to engage with the EU or to address tax good governance shortcomings (situation on 20 February 2024).

- American Samoa, Anguilla, Antigua and Baruda, Fiji, Guam, Palau, Panama, Russia, Samoa, Trinidad & Tobago, Turks & Caicos, US Virgin Islands, and Vanuatu

Evolution of the EU List

Objectives of the EU List

The overall goal of the EU list is to improve tax good governance globally, and to ensure that the EU's international partners respect the same standards as EU Member States do.

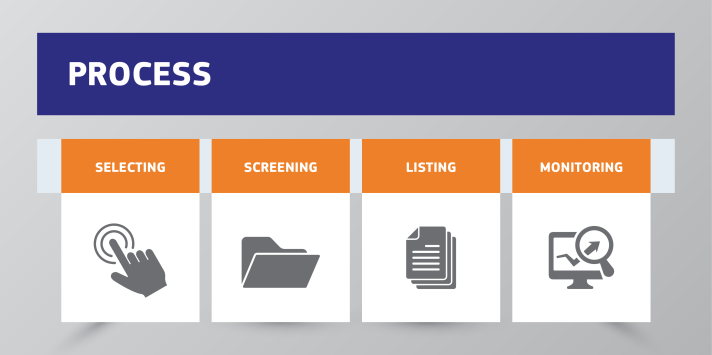

The listing process

The list is a result of a thorough screening and dialogue process with non-EU countries, to assess them against agreed criteria for good governance. These criteria relate to tax transparency, fair taxation, the implementation of OECD BEPS measures and substance requirements for zero-tax countries.

The criteria were agreed by Member States at the November 2016 ECOFIN and used as the basis for a screening "scoreboard".

The EU listing process also had a very positive impact as most jurisdictions engaged constructively with the EU during the listing process. Many made concrete, high level commitments to improve their standards, as a result of the EU screening exercise. This is the major achievement of the EU list process.

EU Member States will continue to monitor the situation, to ensure that jurisdictions implement their commitments.

Listed jurisdictions will be removed from the list once they have addressed EU concerns.

Tax deficiencies identified by the EU in non-cooperative jurisdictions (Annex I) and committed jurisdictions (Annex II)

The purpose of this table is, on the basis of publicly available information and in order to facilitate tax due diligence by EU implementing partners, to compile the tax deficiencies identified by the EU in a) jurisdictions committed to address these deficiencies (mentioned in Annex II of the Council conclusions) and b) non-cooperative jurisdictions (mentioned on Annex I of the Council conclusions, i.e. the EU list of non-cooperative jurisdictions for tax purposes). This table compiles jurisdictions of both categories in alphabetical order but should of course not be seen as another EU list.

Related links

Q&A sheet (situation on 6 October 2020)

Detailed explanation of the methodology and the scoreboard

External Strategy for Effective Taxation

EU anti-tax avoidance requirements on financing and investment operations