One of the benefits of the Internal Market is that EU citizens and businesses have the freedom to move, operate and invest across national borders. But since direct taxation is not harmonised across the EU, this freedom can mean that some taxpayers manage to avoid or evade tax in their country of residence which usually, according to the bilateral tax treaties, has the right to impose tax on worldwide income and assets, even if the income or asset is taxed in the other country. Naturally no double taxation should exist either, and there are agreements in place to avoid this, but the correct amount of taxes must be paid in each relevant country.

Tax authorities in the EU have therefore agreed to cooperate more closely so as to be able to apply their taxes correctly to their taxpayers and combat tax fraud and tax evasion.

Administrative cooperation in direct taxation between the Competent Authorities of the EU Member States helps to ensure that all taxpayers pay their fair share of the tax burden, irrespective of where they work, retire, hold a bank account and invest or do business. This is based upon Council Directive 2011/16/EU which establishes all the necessary procedures, and provides the structure for a secure platform for the cooperation.

Latest News

- 2/2/2024 – publication of COMMISSION IMPLEMENTING REGULATION MISSION IMPLEMENTING REGULATION (EU) 2024/432 of 2.2.2024 determining that the information to be automatically exchanged pursuant to the agreement signed by the competent authorities of Canada and certain Member States is equivalent to the information specified in certain provisions of Council Directive 2011/16/EU. Implementing regulation - EU - 2024/432 - EN - EUR-Lex (europa.eu)

- 1/12/2023 – publication of COMMISSION IMPLEMENTING REGULATION (EU) 2023/2693 of 30 November 2023 determining that the information to be automatically exchanged pursuant to the agreement signed by the competent authorities of New Zealand and certain Member States is equivalent to the information specified in certain provisions of Council Directive 2011/16/EU.

- 24/10/2023: Council Directive (EU) 2023/2226 of 17 October 2023 amending Directive 2011/16/EU on administrative cooperation in the field of taxation (so-called DAC8) – EUR-Lex - 32023L2226 - EN - EUR-Lex

- 6/10/2023: Commission Implementing Regulation (EU) 2023/2389 of 29 September 2023 determining that the information to be automatically exchanged pursuant to the agreement to be concluded between the competent authorities of Finland and the United Kingdom is equivalent to the information specified in certain provisions of Council Directive 2011/16/EU – EUR-Lex - L_202302389 - EN - EUR-Lex

- 18/04/2023: Commission Implementing Regulation (EU) 2023/823 of 13 April 2023 laying down detailed rules for implementing certain provisions of Council Directive 2011/16/EU as regards the assessment and determination of equivalence of information in an agreement between the competent authorities of a Member State and a non-Union jurisdiction – EUR-Lex - 32023R0823 - EN - EUR-Lex

- 8/12/2022: Proposal for a COUNCIL DIRECTIVE amending Directive 2011/16/EU on administrative cooperation in the field of taxation – EUR-Lex - 52022PC0707 - EN - EUR-Lex

- 6/9/2022: Commission Implementing Regulation (EU) 2022/1467 of 5 September 2022 amending Implementing Regulation (EU) 2015/2378 as regards the standard forms and computerised formats to be used in relation to Council Directive 2011/16/EU and the list of statistical data to be provided by Member States for the purposes of evaluating that Directive – EUR-Lex - 32022R1467 - EN - EUR-Lex

- 25/3/2021:COUNCIL DIRECTIVE (EU) 2021/514 of 22 March 2021 amending Directive 2011/16/EU on administrative cooperation in the field of taxation (so-called DAC7, read Rationale for the Introduction of DAC7 for further information)

- 26/06/2020: Council Directive (EU) 2020/876 of 24 June 2020 amending Directive 2011/16/EU to address the urgent need to defer certain time limits for the filing and exchange of information in the field of taxation because of the COVID-19 pandemic

- 08/05/2020 The Commission has decided to propose deferring certain deadlines for filing and exchanging information under the Directive on Administrative Cooperation (DAC). Member States will have three additional months to exchange information on financial accounts of which the beneficiaries are tax residents in another Member State as well as on certain cross-border tax planning arrangements. Similarly, intermediaries or taxpayers liable to report information on certain cross-border tax planning arrangements will have three additional months to do so. Depending on the evolution of the Coronavirus pandemic, the Commission proposes the possibility to extend the deferral period once, for a maximum of three further months. The proposed measures only affect the deadlines for reporting and exchanging information under the DAC. The reportable arrangements made during the postponement period will have to be reported by the time the deferral has terminated. Equally, the exchange of information between Member States on financial accounts and on reportable cross-border tax planning arrangements will resume by the time the deferral has ended. Link to the proposal

- 16/09/2019 : Commission presented the first Evaluation of the Directive, supported by apositive opinion of the Regulatory Scrutiny Boardand published the study supporting this evaluation

- 28/03/2019: New Commission Implementing Regulation for automatic exchange of information on reportable cross-border arrangements

- 17/12/2018: Commission presentedfirst report on automatic exchange of tax information to prevent tax evasion

- 25/05/2018: ECOFIN adopted Council Directive 2018/822/EU amending Directive 2011/16/EU as regards automatic exchange of information on reportable cross-border arrangements.

- 22/01/2018: New Commission Implementing Regulation on statistics and evaluation of the Directive

Areas covered by the Directive

Scope: the scope of the Directive encompasses all taxes of any kind with the exception of VAT, customs duties, excise duties and compulsory social contributions because these are already covered by other Union legislation on administrative cooperation. Also recovery of tax debts is regulated via its own legislation.

The scope of persons covered by particular exchanges of information depends on the subject matter. The Directive covers natural persons (i.e. individuals), legal persons (i.e. companies), and any other legal arrangements like trusts and foundations that are resident in one or more of the EU Member States.

Exchange of Information: the Directive provides for the exchange of specified information in three forms: spontaneous, automatic and on request.

- Spontaneous exchange of information takes place if a country discovers information on possible tax evasion relevant to another country, which is either the country of the income source or the country of residence.

- Exchange of information on request is used when additional information for tax purposes is needed from another country.

- Automatic exchange of information is activated in a cross-border situation, where a taxpayer is active in another country than the country of residence. In such cases tax administrations provide automatically tax information to the residence country of the taxpayer, in electronic form on a periodic basis. The Directive provides for mandatory exchange of five categories of income and assets: employment income, pension income, directors fees, income and ownership of immovable property and life insurance products. The scope has later been extended to financial account information, cross-border tax rulings and advance pricing arrangements, country by country reporting and tax planning schemes. These amendments which extend the application of the original Directive are loosely based on the common global standards agreed by tax administrations at international level, notably at the OECD. However, they sometimes go further and importantly they are legislative rather than being based on political agreement without legislative force. The Directive provides for a practical framework to exchange information - i.e. standard forms for exchanging information on request and spontaneously, as well as computerised formats for the automatic exchange of information – secured electronic channels for the exchange of information and a central directory for storing and sharing information on cross-border tax rulings, advance pricing arrangements and reportable cross-border arrangements ("- tax planning schemes"). Member States are also required to provide a feedback to each other on the use of information received, and to examine together with the Commission how well the Directive supports the administrative cooperation.

- Other Forms of Administrative Cooperation: The Directive provides for other means of administrative cooperation such as the presence of officials of a Member State in the offices of the tax authorities of another Member State or during administrative enquiries carried out therein. It also covers simultaneous controls allowing two or more Member States to conduct simultaneous controls of person(s) of common or complementary interest, requests for notifying tax instruments and decisions issued by the authority of another Member State.

Evolution of the Directive on Administrative Cooperation

Directive 2011/16/EU repealed and replaced Directive 77/799/EEC, which first established the legal basis for administrative cooperation in the field of direct taxation in Europe. The very first experience in exchanging information automatically between EU Member States came from the Directive 2003/48/EC known as the Savings Directive, which was repealed as it was superceded by parts of Directive 2014/107/EU.

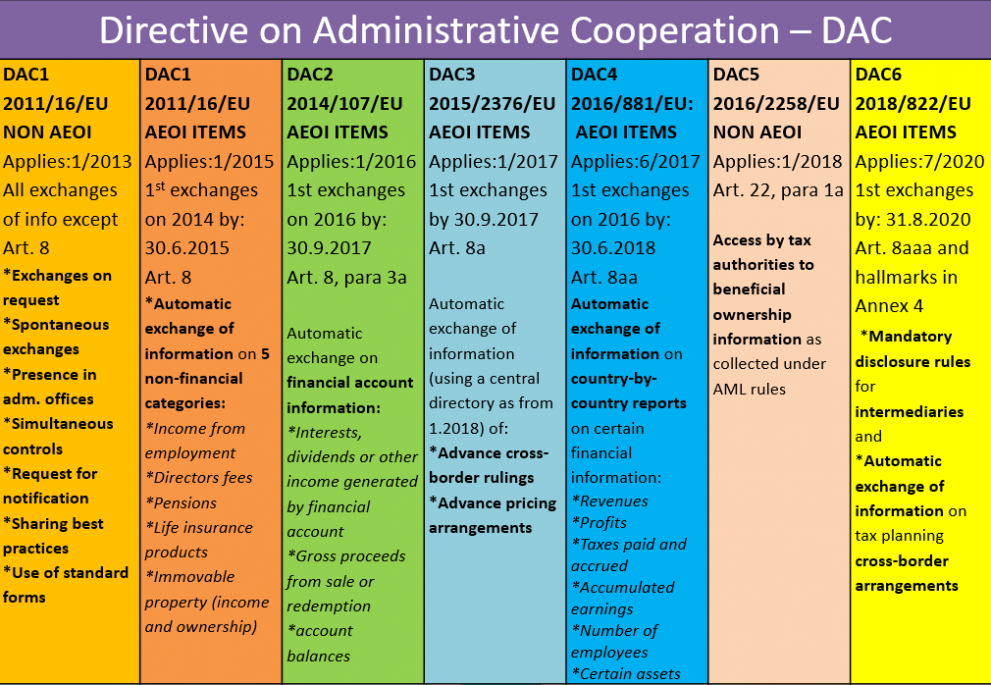

Since its adoption the original Directive 2011/16/EU has been amended five times, with the aim of strengthening the administrative cooperation among Member States.

- Directive 2014/107/EU introduced automatic exchange of financial account information

- Directive 2015/2376/EU on automatic exchange of tax rulings and advance pricing agreements

- Directive 2016/881/EU on automatic exchange of country by country reports

- Directive 2016/2258/EU ensures tax authorities have access to beneficial ownership information collected pursuant to the anti-money laundering legislation

- Directive 2018/822/EU on automatic exchange of reportable cross border arrangements and how the Directive operates.

The EU has signed agreements with five European non-EU countries (Andorra, Liechtenstein, Monaco, San Marino and Switzerland) similar to Directive 2014/107/EU on automatic exchange of financial account information.

An unofficial consolidated version of the original Directive and the first four amendments can be found online here. (the inclusion of the fifth will follow).

On 12 February 2020, the Commission has proposed a codification of Council Directive 2011/16/EU on administrative cooperation in the field of direct taxation and its amendments.

Application of the Directive

The table below shows when the Directives entered into application and when exchanges foreseen by the Directive started or will start to take place. The term AEOI stands for Automatic exchange of information.

Reporting

Article 27 of the Directive requires a report on its application every five years from 1 January 2013. The first report was published in December 2017 accompanied by a staff working document.

A second report under Article 8b of the Directive covering automatic exchange of information was published in December 2018. The report provides an overview and an assessment of the statistics and information received under paragraph 1 of Article 8b. The report is based on statistical data and yearly assessments received from the EU Member States Competent Authorities on the automatic exchanges under Articles 8 and 8a on issues such as the administrative and other relevant costs and benefits of the automatic exchange of information, as well as practical aspects linked thereto.

The first evaluation of the Directive was published in September 2019. It presents the views of the Commission services on administrative cooperation in direct taxation as regards its effectiveness, efficiency, coherence, relevance and EU added value. The executive summary of the evaluation is available in English, FrenchandGerman. The evaluation got a positive opinion by the Regulatory Scrutiny Board. The study supporting the evaluation and itsexecutive summary in English was also published in September 2019.