The Automated Export System (AES) is a Europe-wide system that supports the smooth export of goods out of the Union. It is an evolution of the previous Export Control System (ECS).

AES is used by EU countries’ customs administrations and the UK’s HMRC for the implementation of the Northern Ireland Protocol. It allows for the digitalisation and modernisation of export and exit formalities as required by the Union Customs Code (UCC).

By improving customs processes and offering more trade facilitations, AES reinforces the competitiveness of European businesses.

Latest news

*On 07/02/2025, EU MS voted in favour of the revised Implementing Regulation on Technical Arrangements (IRTA) allowing for the extension of the transition period to the Automated Export System (AES) until 14 December 2025. This extension ensures uninterrupted operational communication among all Member States and the economic operators after 11 February 2025.

*On 26/01/2025, Austria has successfully deployed AES to become the 22nd Member state operating in AES. Economic operators will have a transition window until 31/05/2025.

To present, the Member States operating in AES are Austria, Belgium, Bulgaria, Cyprus, Czechia, Denmark, Estonia, Finland, Germany, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Netherlands, Poland, Romania, Slovakia, Slovenia, Spain, Sweden.

*The updated versions of the AES Business Guidance and the Business Continuity Plan for AES are now available in EN, FR and DE. The links to these documents are available under the documents section below.

Why is the AES important?

In AES, all exchanges of information required by the UCC between customs officers and exporters/declarants are done electronically. This electronic exchange has several benefits for customs officers and traders, including:

- Automatic risk analysis

- Prevention of fraud through document forgery

- Eliminating errors associated with manual recording of declarations

- Cost savings by reduced administrative costs

- Better securing of EU borders

- Predictability

- Efficiency

Furthermore, economic operators (EOs) can benefit from all UCC features and facilitations due to upgraded processes and new functionalities. These include Centralised Clearance at Export, pre-lodged declarations and simplified/supplementary declarations, and a new interface between NCTS and EMCS.

These functionalities allow time savings and more predictability, for cases of export followed by transit, and the export of excise goods under duty suspension arrangements respectively.

The complete implementation of AES in all EU countries will ensure the uniform application of export and exit formalities as defined by UCC, and a level playing field for all economic operators.

Launch of AES

The introduction of AES involves the development of a trans-European system that implements the business processes and data requirements of the UCC in 3 steps:

- The first step covers the core functionalities of the AES. It ensures business continuity of the system with fully automated export and exit formalities. The implementation deadline for National Customs Administrations was 1 December 2023.

- The second step covers the development of a harmonised interface with the Excise Movement Control System (EMCS). The implementation deadline for National Customs Administrations was 13 February 2024.

- The third step covers the new functionalities such as centralised clearance at export, simplified/supplementary declarations, a harmonised interface with the New Computerised Transit System (NCTS), and pre-lodged declarations. The implementation deadline for National Customs Administrations is 2 December 2024.

By 2 December 2024, all National Customs Administrations and EOs shall be ready to operate in AES.

For more details on AES implementation, please consult the UCC Work Programme.

How to prepare

To correctly deploy AES, it is important that national authorities strictly follow the latest available technical specifications. This ensures harmonised implementation across customs authorities.

Particular attention must be paid to conformance testing. This ensures business continuity and ensures a reliable product capable of processing exchanges between all EU countries. Planning for conformance testing is crucial, since this activity can take a significant amount of time.

It is also important to maintain close contact - both between customs administrations and with the trade community - so that all relevant stakeholders are informed about the steps that national authorities are taking.

A newly created UCC feature allowing a person to lodge an export declaration at the customs office where that person is established – the Supervising Customs Office (SCO). The goods to be exported can be presented to customs at any other EU customs office – the Presentation Customs Office (PCO).

AES enables the lodging of an export declaration prior to the expected presentation of goods to customs. This allows the EO to start customs formalities before the goods are available to customs, which speeds up the release of goods for export. In the context of e-commerce, the pre-lodged export declaration may be submitted to the system before the goods are ready to be presented to customs authorities.

AES enables all customs formalities required by the UCC to be done via simplified declaration at export, i.e. the release of goods is granted based on a reduced dataset (simplified declaration). The complete dataset (supplementary declaration) can be submitted after the release.

AES features a new national interface with NCTS-P5 to facilitate the closure of export movements when goods are placed under a transit procedure after being declared for export.

A new link with EMCS ensures better monitoring and control of excise goods under duty suspension arrangements to be taken out of EU Customs Territory.

UCC processes covered by AES

AES manages export and exit formalities for goods leaving the customs territory of the Union. This is done via an export or re-export declaration, an exit summary declaration, or a re-export notification, depending on the specific situation.

- Customs formalities at the Customs Office of Export, or in case of Centralised Clearance, at the Supervising Customs Office (SCO). This includes customs declaration acceptance, amendment and invalidation, customs controls at export, goods release at export and certification of exit. For SCOs, this may also include forwarding the request to the Presentation Customs Office (PCO) for physical controls.

- Customs formalities at the Customs Office of Exit. This includes the presentation of goods at exit, customs controls at exit, goods release for exit and providing information to the customs office of export about the exit of the goods.

- Customs formalities at the PCO (in the case of Centralised Clearance). This includes handling pre-release recommendations from the SCO, handling control recommendations from the SCO and customs controls at the PCO.

- Customs formalities at the Customs Office of Exit, including EXS acceptance, customs controls, goods release for exit and EXS amendment or invalidation.

- Customs formalities at the Customs Office of Lodgement, including EXS acceptance and forwarding the EXS to the customs office of exit.

- Customs formalities at the Customs Office of Exit, including REN acceptance, customs controls, goods release for exit and REN amendment or invalidation.

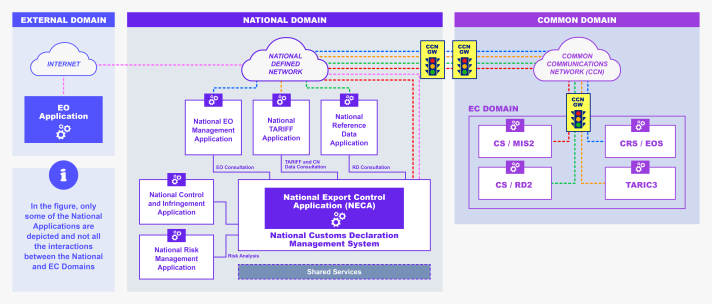

Interfaces with other IT systems

AES has interfaces with several systems and applications, including:

AES connects with national risk analysis systems and ensures that risk analysis is initiated. This happens once transit data is received and validated by AES (in case of pre-lodged declarations) or once the customs declaration is accepted (in all other cases).

National risk analysis systems then carry out the required analysis and sends the results back to AES, along with control recommendations.

When EOS-registered traders are to be declared in an AES message, the unique Economic Operators Registration and Identification (EORI) number shall be declared. When validating a received AES message, AES consults EOS through the CRS to check the provided EORI number.

CDS enables electronic processing and central storage of applications and authorisations, as well as the publication of the list of holders on the Internet.

This system facilitates the necessary consultations between EU countries’ customs authorities during the decision-taking period and the management of the authorisations process.

When validating a received data set for which authorisations are valid in more than one EU country, NCTS consults the CDS to check the existence and validity of the customs decisions.

AES connects to NCTS when export is followed by transit. Part of the so-called national domain, this is to synchronise and optimise transit and export procedures and avoid open movements.

For both external and internal transit, NCTS and AES exchange the following information:

- Initial cross-check of export MRN(s) referenced in the transit declaration (before acceptance of transit declaration).

- Allocation of export MRN(s) referenced in the transit declaration (upon acceptance of transit declaration).

- At the Customs Office of Departure, NCTS informs AES at the Customs Office of Exit that there are positive/negative Control Results.

- In exceptional cases of recovery, NCTS will inform AES at the start of the recovery.

- The Transit declaration is amended.

- The Transit declaration is invalidated.

AES connects to EMCS to automate existing processes and exchange information between excise and customs authorities. This provides more certainty to exporters while facilitating the control of excise movements and the fight against fraud.

Documents

- AES Business Guidance (EN, FR and DE): https://taxation-customs.ec.europa.eu/customs-4/union-customs-code/ucc-guidance-documents_en

- Business continuity Plan (EN, FR and DE): https://circabc.europa.eu/ui/group/cac828e9-6887-4721-80c1-50186bc8fe08/library/89ea5727-97f0-4995-ace6-416e18199a62

- Export and Exit out of the EU – Guidance for Member States and Trade

The BCP for AES document contains the common fallback measures in case of a temporary failure of AES to ensure the business continuity of operations, notably, to allow the Common Domain (CD) communications between customs offices located in different Member-States (as per UCC legislation), in case of urgency in the release of the goods.

The BCP for AES also includes recommended fallback measures to cover the External Domain (ED) communications between declarant/exporter and involved customs offices, nonetheless, the measures applicable in each MS for the ED communications are determined by the respective national customs authorities.

Legal texts

- Union Customs Code (UCC) Legal Package

- UCC Work Programme

- Commission Delegated Regulation (EU) 2015/2446 of 28 July 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards detailed rules concerning certain provisions of the Union Customs Code

- Commission Implementing Regulation (EU) 2015/2447 of 24 November 2015 laying down detailed rules for implementing certain provisions of Regulation (EU) No 952/2013 of the European Parliament and of the Council laying down the Union Customs Code

- Commission Implementing Decision (EU) 2023/2879 of 15 December 2023 establishing the Work Programme relating to the development and deployment for the electronic systems provided for in the Union Customs Code

- Commission Delegated Regulation (EU) 2016/341 of 17 December 2015 supplementing Regulation (EU) No 952/2013 of the European Parliament and of the Council as regards transitional rules for certain provisions of the Union Customs Code where the relevant electronic systems are not yet operational and amending Delegated Regulation (EU) 2015/2446

Important links

- UCC Work Programme - incl. national project plans for AES and NCTS