The Excise Movement and Control System (EMCS) is a computerised system for recording and monitoring the movement of excise goods (alcohol, tobacco and energy products) in the EU.

More than 190,000 economic operators currently use the system. It is a key facilitation instrument for EU economic operators trading excise goods and a crucial tool for information exchange and cooperation between EU countries.

Purpose

The purpose of the EMCS is to:

- Combat fiscal fraud with real-time information and checks on goods being moved under duty-suspension

- Ensure the secure commercial movement of excise goods

- Simplify procedures for traders, with a standardised, electronic system for the whole EU

- Speed up the release of guarantees when goods arrive at their destination

- Create paperless administration

How does it work?

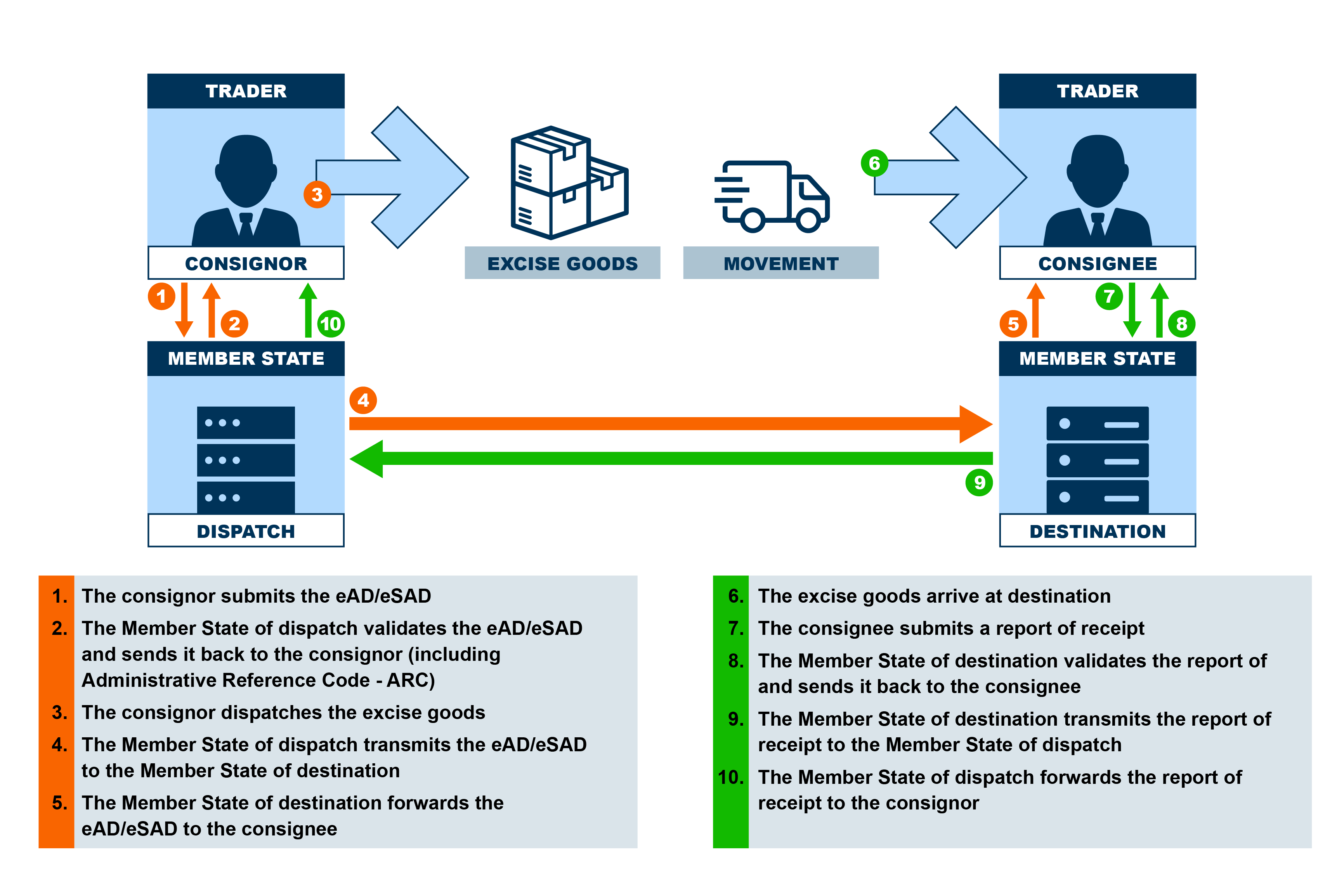

Under EMCS, the movement of excise goods is documented at every stage through an electronic Administrative Document (e-AD), for duty suspension goods, or through an electronic Simplified Administrative Document (e-SAD) in the case of duty paid movements.

EMCS movement scheme:

- The consignor submits the eAD/eSAD;

- The Member State of dispatch validates the eAD/eSAD and sends it back to the consignor (including Administrative Reference Code – ARC);

- The consignor dispatches the excise goods;

- The Member State of dispatch transmits the eAD/eSAD to the Member State of destination;

- The Member State of destination forwards the eAD/eSAD to the consignee;

- The excise goods arrive at destination;

- The consignee submits a report of receipt;

- The Member State of destination validates the report of receipt and sends it back to the consigner;

- The Member State of destination transmits the report of receipt to the Member State of dispatch;

- The Member State of dispatch forwards the report of receipt to the consignor.

- The e-AD/e-SAD is issued by the original consignor, containing information on the consignment and the planned movement within the EU.

- The e-AD/e-SAD is validated in the Member State of dispatch. A European register of operators (SEED) is used to check the excise numbers of the consignor and consignee.

- The e-AD/e-SAD is electronically transmitted by the Member State of dispatch to the Member State of destination.

- The Member State of destination forwards the e-AD/e-SAD to the consignee

- The consignee submits a "report of receipt" once he/she has received the excise goods. This report should mention any anomalies, such as shortages or excesses in the consignment.

- The report of receipt is sent to the consignor. Based on the report of receipt the consignor will be able to discharge the movement and recover the financial guarantees they had to make (in case of duty suspension) or to request a refund of the duties paid before dispatch (in case of duty paid movement)

The content of the e-AD and e-SAD is laid down in Directive 2020/262 and Delegated Regulation 2022/1636, whereas the rules for their use are defined in Implementing Regulation 2022/1637.

System of Exchange of Excise Data (SEED)

SEED is a register of economic operators. It can be used by traders to check whether a given excise number is valid and what categories of goods the operator in question is authorised to trade.

It is a core component of the EMCS, as it allows EU countries’ administrations to validate authorisations of traders before giving them permission to move any excise goods under duty suspension. SEED also includes operators authorised to move goods in duty paid status (certified consignor and certified consignee).

ARC Follow-up

ARC Follow-up is the service available to Economic Operators and Member States officials that shows the state of EMCS international movements through the Europa website. It is sufficient to enter an ARC (Administrative Reference Code) to get the state of the corresponding EMCS movement.

EMCS: EU countries’ websites

Austria / Belgium (French/Dutch) / Bulgaria / Croatia / Cyprus / Czechia / Denmark / Estonia / Finland / France (GAMMA for e-AD/GAMMA for e-SAD) / Germany / Greece / Hungary / Ireland / Italy / Latvia / Lithuania / Luxembourg / Malta / Netherlands (Business information/Information on system status) / Poland / Portugal / Romania / Slovakia / Slovenia / Spain / Sweden

Legal texts

- Council Directive (EU) 2020/262 of 19 December 2019 laying down the general arrangements for excise duty; information how Members States have implemented optional provisions of the Directive is contained in this document

- Council Regulation (EU) No 389/2012 of 2 May 2012 on administrative cooperation in the field of excise duties and repealing Regulation (EC) No 2073/2004

- Commission Delegated Regulation (EU) 2022/1636 of 5 July 2022 supplementing Council Directive (EU) 2020/262 by establishing the structure and content of the documents exchanged in the context of movement of excise goods, and establishing a threshold for the losses due to the nature of the goods

- Commission Implementing Regulation (EU) 2022/1637 of 5 July 2022 laying down the rules for the application of Council Directive (EU) 2020/262 as regards the use of documents in the context of movement of excise goods under a duty suspension arrangement and of movement of excise goods after release for consumption, and establishing the form to be used for the exemption certificate

- Commission Implementing Regulation (EU) 2016/323 of 24 February 2016 laying down detailed rules on cooperation and exchange of information between Member States regarding excise goods pursuant to Council Regulation (EU) No 389/2012

- Commission Implementing Regulation (EU) No 612/2013 of 25 June 2013 on the operation of the register of economic operators and tax warehouses, related statistics and reporting pursuant to Council Regulation (EU) No 389/2012 on administrative cooperation in the field of excise duties

- Decision (EU) 2020/263 of the European Parliament and of the Council of 15 January 2020 on computerising the movement and surveillance of excise goods

Useful links

- History of EMCS

- ELearning module on EMCS

- Frequently Asked Questions on EMCS

- Report COM (2017) 184 on the implementation and evaluation of Council Directive 2008/118/EC of 16 December 2008 concerning the general arrangements for excise duty

- Use by the Member States of the optional provisions of Chapters IV and V of Directive (EU) 2020/262 concerning the movement of excise goods and of the optional data in Annex I of Commission Delegated Regulation (EU) 2022/1636