The TaxCompeu

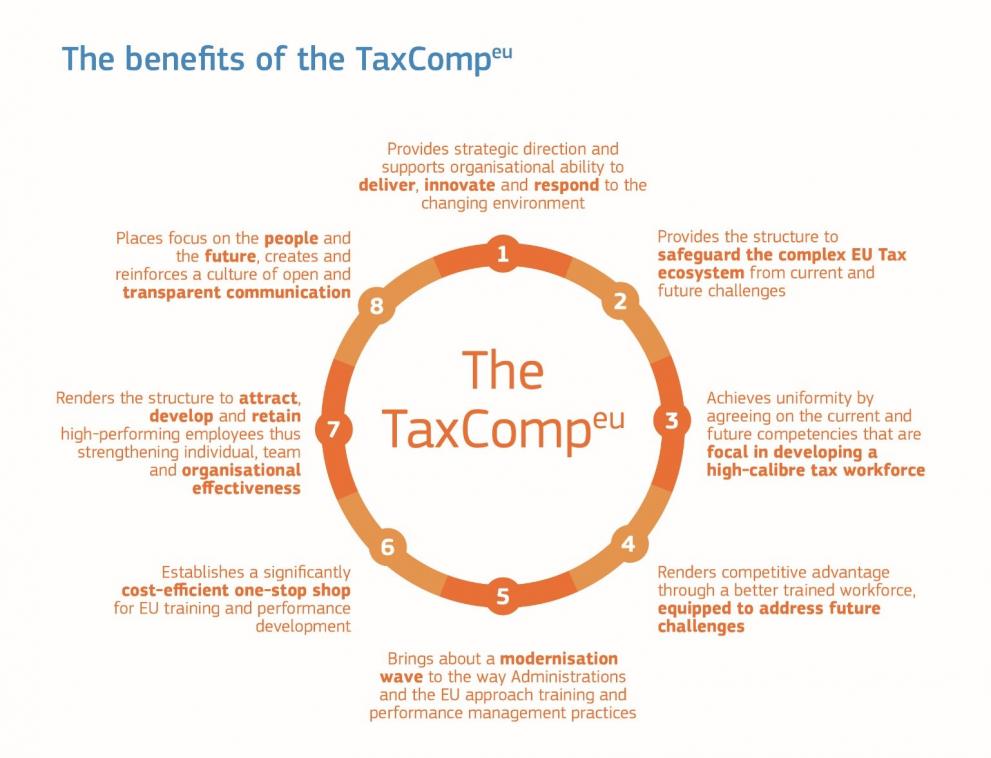

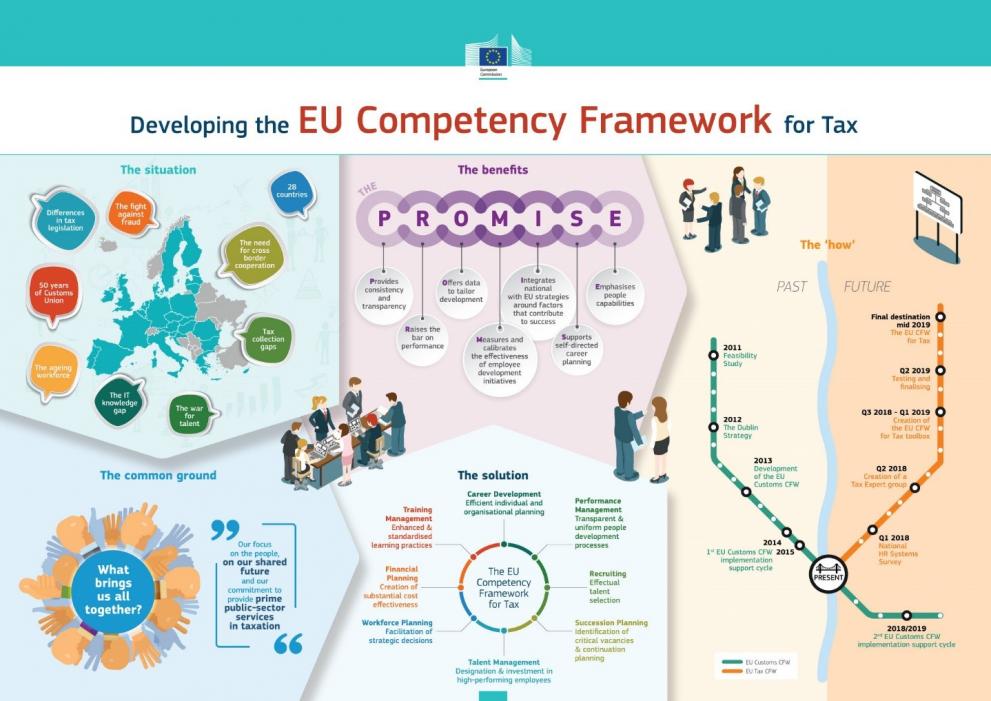

A standardised approach to training and performance development, the TaxCompeu comprises a guiding framework and toolset that aims to connect Human Resources (HR) processes under a pan-European, tax-specific, competency-based methodology. As such, it has the potential to constitute the backbone for national HR practices as well as a common language for Member States (MS) and the European Union (EU) as they seek to provide prime public-sector services across the EU through a better trained, more efficient tax workforce.

The TaxCompeu is currently available in English and will shortly be available in 22 EU languages.

The TaxCompeu vision

Competency-based HR management is the bridge between HR management and an organisation’s overall strategic plan. Competencies can be defined as ‘observable knowledge, skills and behaviours needed for successful job performance’. A competency framework defines the knowledge, skills and attributes required in each role to perform the job effectively.

Drawing on similar work undertaken for the CustCompeu, the TaxCompeu comprises a twin set of tools based on the same easy-to-follow methodology as used for Customs, but different in technical content specifically designed for the EU Tax function. This way, the process of developing the TaxCompeu has benefitted from the wealth of experience built up by the CustCompeuwhile treating significant tax particularities in a way that creates a relevant, suitable fit for the tax discipline.

Incorporating the TaxCompeu into national HR processes will provide MS with new insight, knowledge and tools to implement top-of-the-line people management practices, which in turn will help promote a strong, powerful national presence within the world of EU Tax.

What is the TaxCompeu

This section describes the overall framework, including a high-level overview of each element of the TaxCompeu.

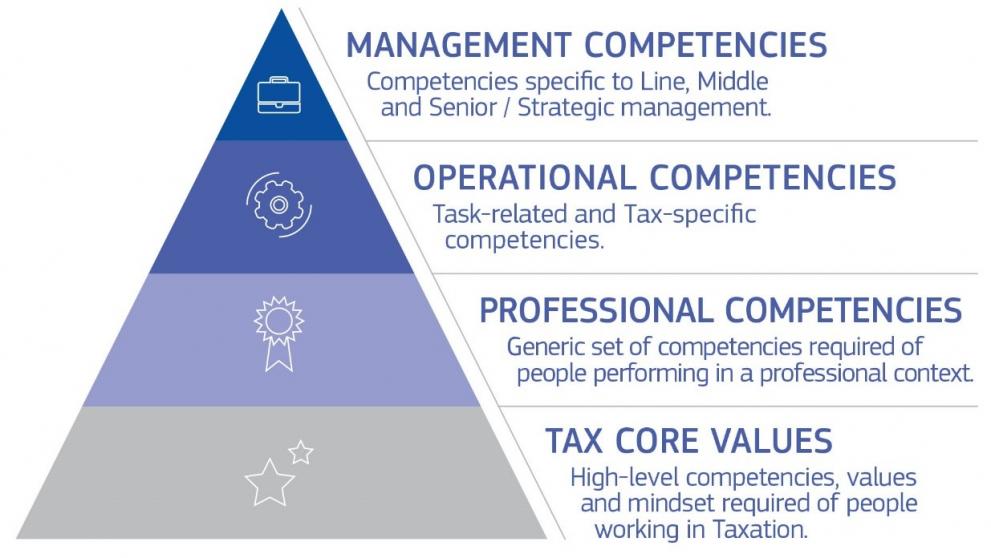

TaxCompeu Core Values and Competencies

The key ingredient to delivering a high and consistent standard of tax service is to empower employees with the competencies they need to deliver these services. This complete set of required competencies, documented with a European-wide focus, is what constitutes the TaxCompeu.

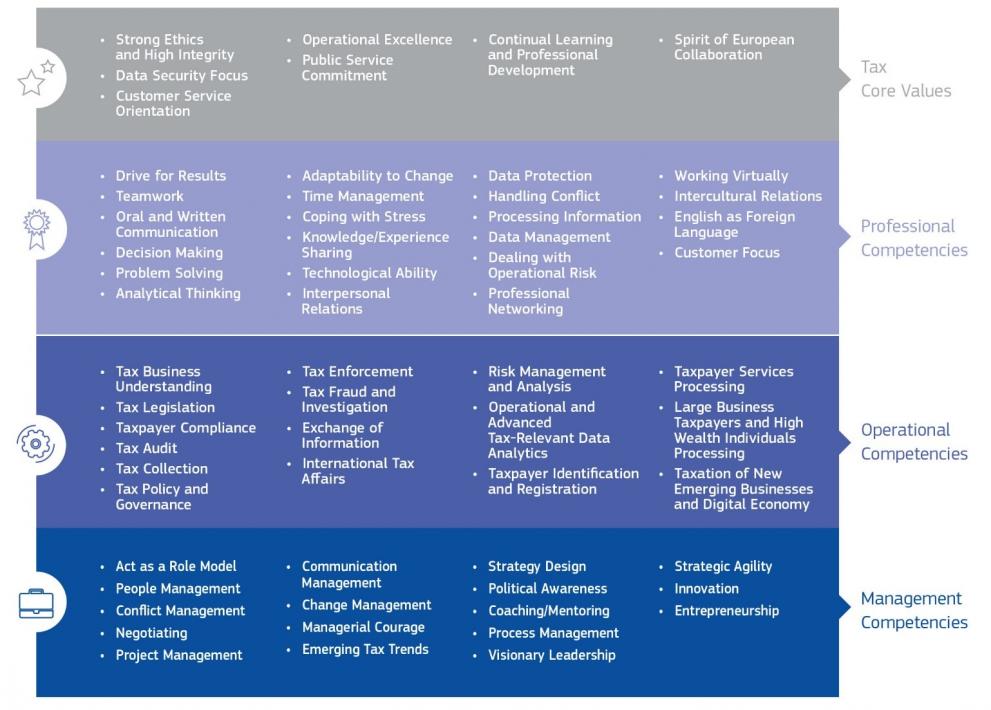

The EU competencies are further split into three categories: Tax Professional Competencies, Tax Operational Competencies and Tax Management Competencies.

Each category has its own purpose. The Professional Competencies are typically transferable between roles within tax and beyond. The Operational Competencies are specific to roles where employees work directly on tax-related tasks. The Management Competencies are targeted to roles where there is a management or team-leading focus.

EU competencies are complemented by a set of Tax Core Values. EU Tax values are common principles that define the employee’s work ethic and their alignment to the overall Tax mission. These values are the definition of what it means to work in the field of European Taxation.

TaxCompeu Proficiency Levels

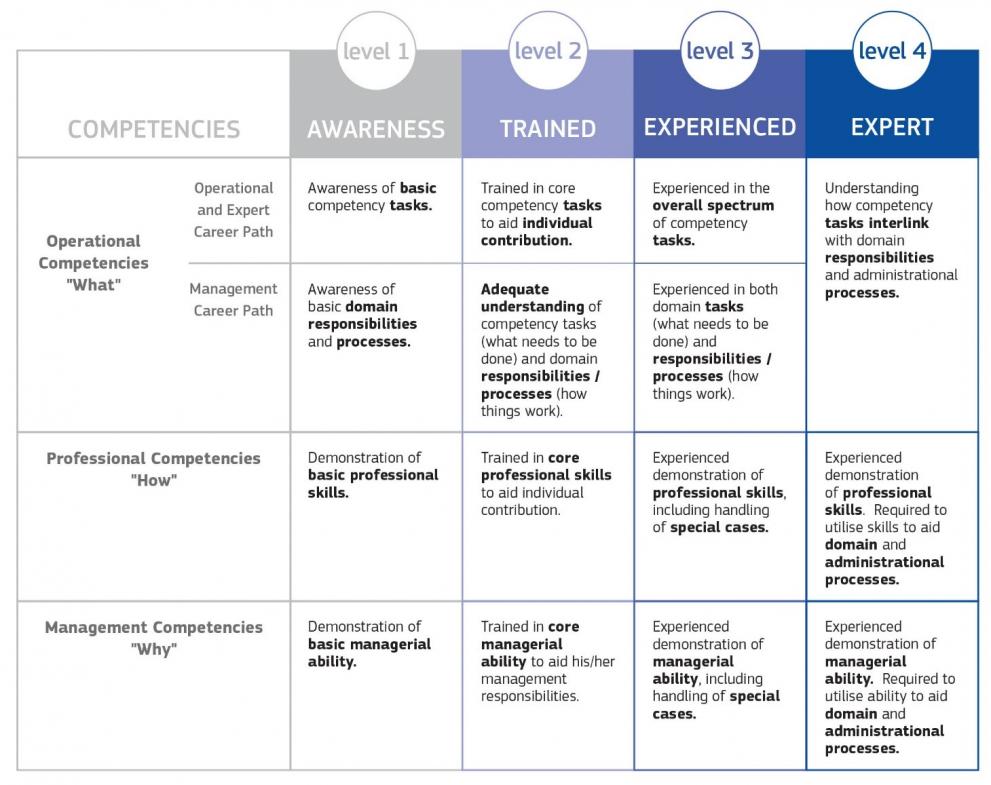

A Proficiency Level summarises the required level of proficiency for someone within a certain role. In combination with the competencies required for a certain role, it should mirror both the importance of the competency and the frequency of when it is required in the role. The Proficiency Levels used within the Competency Framework apply to all the competencies in the framework (Professional, Operational and Management Competencies). There are four levels ranging from 1 (Awareness) to 4 (Expert). The Proficiency Levels do not apply to the seven Tax Core Values since all Tax professionals are expected to adhere to and demonstrate these values.

TaxCompeu Career Model

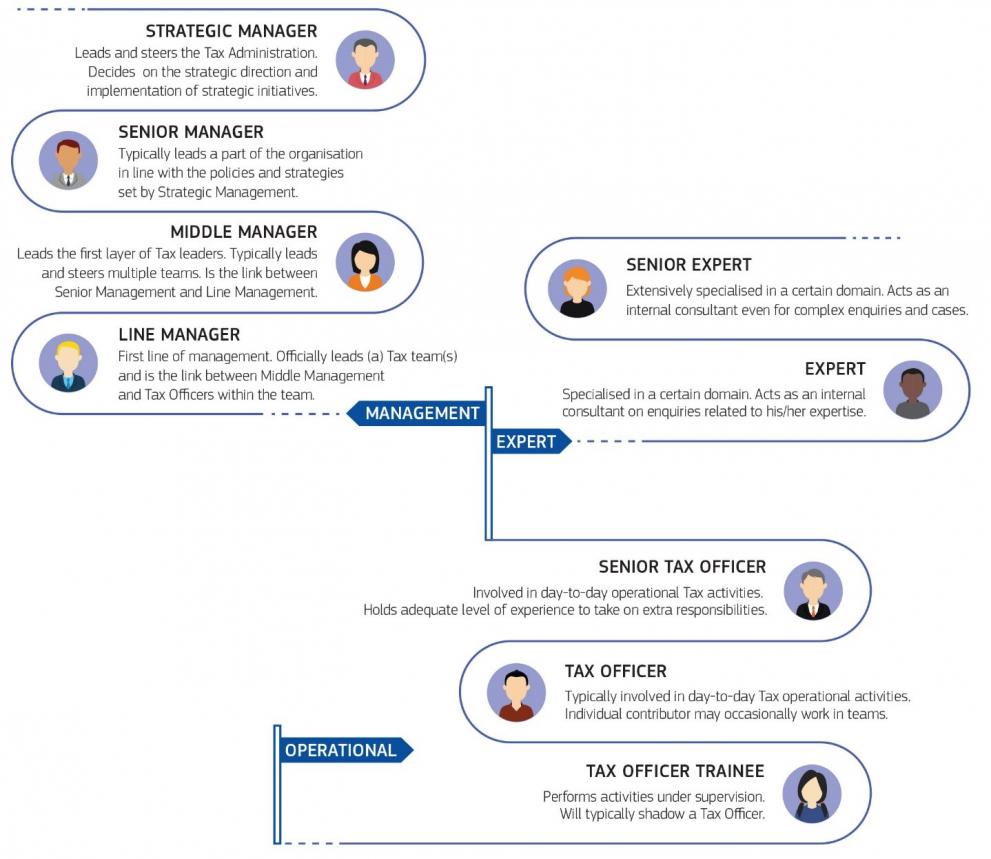

Career models are part of the HR development processes within organisations. They are composed of distinct career paths that imply vertical growth or advancement to higher level positions, but they can also entail lateral movement within or across domains. Career paths are designed to provide structure and transparency regarding the abilities, training and experience that qualify career progression. Moreover, they offer a standardised approach through which MS can define training needs and measures, structure recruitment to identify roles to be fulfilled and validate performance evaluation processes. Τhe EU TaxCompeu career model currently identifies the following three career paths:

- Operational Career Path, includes roles from Tax Officer Trainee to Tax Senior Officer. Roles within this Career Path are typically involved in the day-to-day operational Tax activities.

- Expert Career Path, includes the roles of Tax Expert and Senior Tax Expert. Roles within this Career Path are typically specialised in a certain domain, thus building substantial working experience and in-depth knowledge in this area.

- Management Career Path, includes roles from Line to Strategic Manager that typically involve operational and/or strategic management responsibilities.

TaxCompeu Functional Domains

EU Tax Functional Domains correspond to the logical segmentation of a Tax Administration to its subsequent tax functions. Such functions occupy a definite place on the organisational chart and are led by a functional manager (in most cases a Senior Manager). EU Tax Functional Domains define groupings of Tax activities and/or processes and serve the purpose of mapping the organisational structure of a Tax Administration, along with the relevant roles in all hierarchical levels.

The EU Tax Functional Domains serve as a map to identify the distinctive tax business areas, the differentiation in tasks and responsibilities (further depicted in the TaxCompeu role descriptions), and the optimal competency blend required by the roles operating in them.

The following six core domains were designated as integral functions of a Tax Administration. To complement the list, a supportive function was also introduced, catering for ancillary operations (e.g. HR, Training, ICT) that are considered essential in the day-to-day operations of the Tax Administration.

- Tax Policy and Law

- Taxpayer Services

- Tax Collection

- Tax Audit

- Risk Management

- Tax Fraud and Investigation

- Supportive Functions

TaxCompeu Role Descriptions & Competency Profiles

Role Descriptions describe the skills, responsibilities and optimal blend of competencies Tax professionals are expected to learn to be considered successful for their roles. Moreover, they define where the role fits within the overall hierarchy of an organisation.

TaxCompeu Role Descriptions - Tax Policy and Law

TaxCompeu Role Descriptions - Taxpayer Services

TaxCompeu Role Descriptions - Tax Collection

TaxCompeu Role Descriptions - Tax Audit

TaxCompeu Role Descriptions - Risk Management

TaxCompeu Role Descriptions - Tax Fraud and Investigation

TaxCompeu Role Descriptions - Supportive Functions

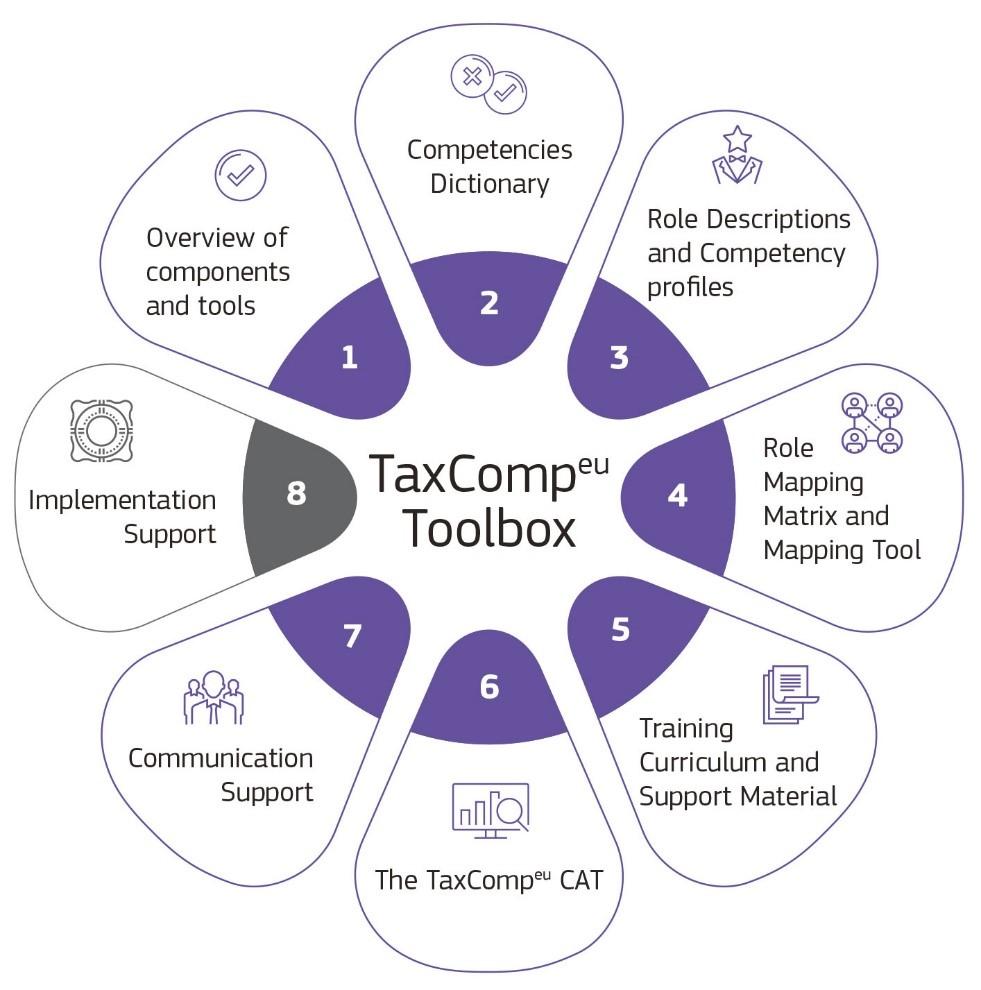

The complete TaxCompeu Toolbox

The TaxCompeu consists of the following documents and supporting tools:

1. TaxCompeu Overview (link)– Pdf document describing the full functionality of the framework for EU Taxation.

2. TaxCompeu Competency Dictionary (link) – Pdf document containing detailed descriptions of the Core Values, and Professional, Operational and Management Competencies. Also provides Proficiency Levels descriptions.

3. TaxCompeu Role Descriptions (links) – Eight documents containing scope and task descriptions per functional domain and hierarchical level, as well as a competency profile specific to each role:

3.1. TaxCompeu Role Descriptions – Tax Policy and Law

3.2. TaxCompeu Role Descriptions – Taxpayer Services

3.3. TaxCompeu Role Descriptions – Tax Collection

3.4. TaxCompeu Role Descriptions – Tax Audit

3.5. TaxCompeu Role Descriptions – Risk Management

3.6. TaxCompeu Role Descriptions – Tax Fraud and Investigation

3.7. TaxCompeu Role Descriptions – Supportive Functions

3.8. TaxCompeu Role Descriptions – Cross Functional

4. TaxCompeu Role Mapping Matrix (link) - Excel file containing common Tax roles in an EU Tax Administration, including role descriptions, high-level tasks per role and a competency profile specific for each role and TaxCompeu Mapping Tool (link) – Excel file to develop role profiles custom to national Administration needs.

5. The TaxCompeu Training Curriculum, currently under development.

6. TaxCompeu Communication support:

a. TaxCompeu Communication Messages (link) – Pdf document containing major communication arguments towards leadership, HR departments and executives, employees within the Tax Administration and other general audiences, to help support TaxCompeu Implementation initiatives.

b. TaxCompeu Europa webpage – containing all relevant TaxCompeu information.

c. TaxCompeu Infographics (links).

7. TaxCompeu Implementation support initiatives to be announced.