New rules on tax dispute resolution apply since 1 July 2019. They are laid down in Council Directive 2017/1852 of 10 October 2017 and bring a significant improvement to resolving tax disputes, as they ensure that businesses and citizens can resolve disputes related to the interpretation and application of tax treaties more swiftly and effectively.

The new rules also cover issues related to double taxation which occurs when two or more countries claim the right to tax the same income or profits of a company or person. This can happen, for example, due to a mismatch in national rules or different interpretations of the transfer pricing rules in a bilateral tax treaty.

There are currently around 900 double taxation disputes in the EU and they are, estimated to be worth €10.5 billion.

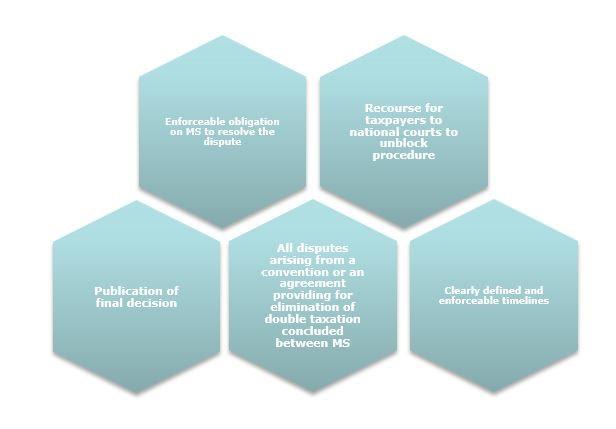

As such, taxpayers now enjoy enhanced legal certainty when it comes to seeking a solution to their cross-border tax disputes. In particular, a wider range of cases is covered and Member States have to comply with clear deadlines in order to agree on a binding solution, giving citizens and companies more timely decisions.

The key aspects of the new rules

MAP in a nutshell

Mutual agreement procedure (MAP) is an administrative procedure between the competent authorities of Member States engaged in a tax dispute. During the MAP, the competent authorities endeavour to resolve the dispute. The timelimit of the Directive for a MAP is 2 years, or 3 years if this is extended on a justified request by a competent authority.

Dispute resolution procedure in a nutshell

In case the dispute is not resolved with a MAP between competent authorities, the taxpayer can request to set up an Advisory Commission. The Advisory Commission is composed of the competent authorities of the Member States in dispute and three independent persons (one of whom acts as the Chair). These persons are drawn from a purpose-compiled list to which they get nominated by Member States in accordance with the Directive.

The competent authorities sitting in the Advisory Commission have to agree on Rules of Functioning that provide for details on the procedure. In case the Rules of Functioning are not notified to the taxpayer or are notified incomplete, the members shall use the standard Rules of Functioning (Annex I, Part I).

Once set-up, the Advisory Commission has to deliver its opinion within 6 months.

List of independent persons

It will be available and published online after October 2019.

Final decisions

After the Advisory Commission delivers its opinion, the opinion is notified to the competent authorities. On the basis of this opinion, the competent authorities of the Member States concerned make a final decision. If they do not manage to agree a final decision on time, the opinion becomes binding on the competent authorities.

Details of the decisions will be published online.

Related links

- Council Directive (EU) 2017/1852 of 10 October 2017 on tax dispute resolution mechanisms in the European Union

- Commission Implementing Regulation (EU) 2019/652 of 24 April 2019 laying down standard Rules of Functioning for the Advisory Commission or Alternative Dispute Resolution Commission and a standard form for the communication of information concerning publicity of the final decision in accordance with Council Directive (EU) 2017/1852

- Read the July 2019 Press Release

- Read the October 2017 Press Release

- Action Plan for a Fair and Efficient Corporate Tax System in the EU

- Commission Proposal for a Council Directive on Double Taxation Dispute Resolution Mechanisms in the EU - Annex

- Press release on the "October package" - Q&A (MEMO)

- Impact Assessment - Summary