Overall Relations

Customs relations and cooperation between the EU and Moldova are part of the EU's overall political and economic relations with this country. Moldova is a partner country of the Eastern Partnership, since its foundation in 2009, and of the European Neighbourhood Policy, as well since its creation in 2004. In 2022, the EU and Moldova agreed on a new Association Agenda.

Moreover, since 28 April 2014, Moldovan citizens benefit from visa liberalisation, facilitating travel, business and people-to-people contacts, which lead to more than 2.5 mio Moldovan citizens to visit the EU without a visa. In addition, the EU assistance in the area of higher education is provided via the Erasmum + Programme, with 1,179 short term mobilities for higher education students, staff and researchers, and 3,700 beneficiaries, in the 2015-2020 period, between students and academic staff.

The Association Agreement between the European Union and the European Atomic Energy Community and their Member States with Moldova, signed on 27 June 2014 and entered into force on 1 July 2016, contains a number of economic and trade cooperation rules, including general provisions on:

- Customs and trade facilitation (Chapter 5, art. 192-201)

- Taxation (Chapter 8, art. 52-57)

As of 23 June 2022, Moldova has been granted candidate status on the understanding that steps are taken in a number of areas. The decision also takes into account Moldova's efforts in implementing their obligations under the Association Agreement, including the Deep and Comprehensive Free Trade Area, which cover significant parts of the EU acquis.

Trade relations

The EU and Moldova Association Agreement introduces a preferential trade regime, the Deep and Comprehensive Free Trade Area (DCFTA). This preferential trade system has allowed Moldova to benefit from reduced or eliminated tariffs for its goods, an increased services market and better investment conditions. Furthermore, an important part of the DCFTA is aligning Moldovan trade-related laws to selected EU legislative acts. Moldova has been a member of the World Trade Organisation since 2001 (July 26, 2001) and joined the Pan-Euro-Med Convention in 2016 (December 1).

Customs relations

Moldova joined the World Customs Organisation in 1994 (October 28, 1994).

The EU and Moldova Association Agreement

- Allows the removal of import duties for most goods traded between the EU and Moldova.

- Provides for broad mutual access to trade in services for both partners.

- Provides the chance to both EU and Moldovan companies to create a subsidiary or a branch office on a non-discriminatory basis. This means they receive the same treatment as domestic companies in the partner's market when setting up a business.

The EU and Moldova Customs Sub-Committee (art. 200) provides the operative framework for regular consultations and monitoring of the implementation and the administration of Chapter 5, including the matters of customs cooperation, cross-border customs cooperation and management, technical assistance, rules of origin, trade facilitation, as well as mutual administrative assistance in customs matters.

Within the Commission:

- TAXUD is in charge of the management of the customs section of the Agreement.

- OLAF deals with anti-fraud issues.

Recently, the Republic of Moldova became the first country in the region to obtain mutual recognition of Authorized Economic Operators (AEO) with the EU. This new agreement means that both the EU and the Republic of Moldova will mutually recognise each other’s AEOs programmes, bringing together traders who meet certain criteria and who can therefore benefit from simplified customs arrangements. As of 1 November 2022, both the EU and Moldova will provide reciprocal benefits to each other’s AEOs, such as fewer customs controls and priority treatment at customs clearance.

Tax relations

The EU and Moldova Association Agreement

- Implementing the principles of good governance in the tax area, i.e. the principles of transparency, exchange of information and fair tax competition, as subscribed to by the Member States at the EU level.

- Enhances and strengths of the cooperation aimed at the improvement and development of the Republic of Moldova's tax system and administration, including the enhancement of collection and control capacity, with a specific focus on Value Added Tax (VAT) refund procedures, to avoid the accumulation of arrears, ensure effective tax collection and reinforce the fight against tax fraud and tax avoidance.

- Provides for gradual approximation of the indirect tax legislation to the EU, namely the EU legislation of VAT and excise duties.

- Taxation issues are discussed once a year during the cluster II sub-committee chaired by EEAS.

Background information

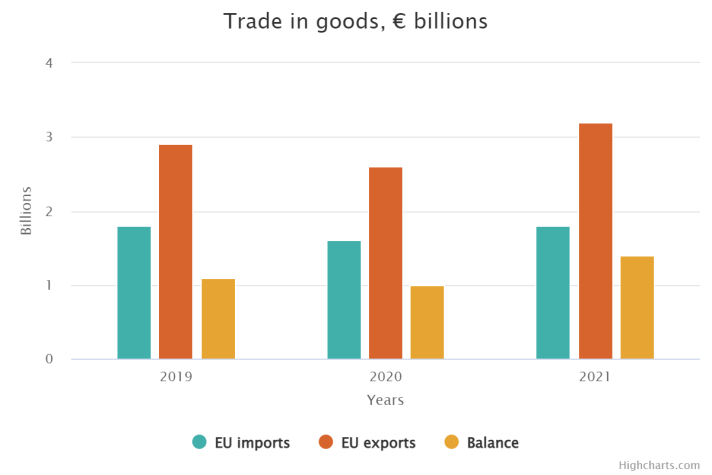

The EU is Moldova’s biggest trade partner, counting for 52.2% of its total trade, followed by Russia (10.5%) and China (8.3%). On the other hand, Moldova ranks 56th among the EU’s trade partners, with a total turnover of around €5 billion in 2021. In terms of composition, the EU’s exports to the country are mainly composed of machinery and appliances, and mineral products, while the imports are mainly electrical machinery and appliances, base metals and articles thereof, and vegetable products. Looking at the statistics, the EU’s exports to Moldova amounted in 2021 to €3.8 billion, with an increase of about 22% from 2020, while the imports increased by 13.4% in 2020-2021, passing from €1.61 billion to €1.83 billion in 2021, showing growth after small decreases in the previous two years. Finally, the EU is the biggest investor in Moldova.