Cette page web est en cours de traduction – elle sera disponible en français prochainement.

Nous vous remercions de votre patience.

Overall relations

Customs relations and cooperation between the EU and Japan are part of the EU's overall political and economic relations with that country.

The Strategic Partnership Agreement between the European Union and its Member States, of the one part, and Japan, of the other part contains a number of economic and trade cooperation rules, including general provisions on:

- Customs (Article 18);

- Taxation (Article 19).

EU-Japan Economic Partnership Agreement (EPA)

The Economic Partnership Agreement (EPA) between the European Union and Japan applies since 1 February 2019.

For Customs, the following Chapters are relevant:

- Chapter 3: Rules of Origin and Origin Procedures

- Chapter 4: Customs Matters and Trade Facilitation

The text of the EPA is available in the Official Journal of the European Union L 330 of 27.12.2018

To implement Section B of Chapter 3 on Origin Procedures, DG TAXUD of the European Commission developped the following Guidance documents:

- EU-Japan EPA Guidance: Statement on Origin for multiple shipments of identical products (revised)

- EU-Japan EPA Guidance: Importer’s knowledge

- EU-Japan EPA Guidance: Confidentiality of information

- EU-Japan EPA Guidance, Claim, Verification and Denial (revised)

- EU-Japan Guidance, Statement on Origin

The following Guideline was developed by Japan Customs: Guideline for the statement on origin/importer's knowledge and verification under the Japan-EU EPA, also available in Japanese.

Specific questions on the implementation of the EU-Japan EPA can be sent to the following mailbox: TAXUD-E5_EU_JAPAN_EPA ec [dot] europa [dot] eu (TAXUD-E5_EU_JAPAN_EPA[at]ec[dot]europa[dot]eu)

ec [dot] europa [dot] eu (TAXUD-E5_EU_JAPAN_EPA[at]ec[dot]europa[dot]eu)

Customs relations

The customs cooperation between the EU and Japan is based on the Agreement on Cooperation and Mutual Administrative Assistance in Customs Matters that entered into force on 1 February 2008.

The agreement

- provides a framework for cooperation between the customs authorities;

- promotes trade facilitation for reliable traders;

- supports the fight against fraud;

- improves cooperation in the area of risk management.

Mutual Recognition of Authorised Economic Operators (AEOs) between the EU and Japan

The Decision on the mutual recognition of authorised economic operators (AEOs) entered into force on 24 May 2011. Since then, both EU and Japanese AEOs have enjoyed trade facilitation benefits in the partner countries.

Read the Decision

Read the communication

On the 26th of June representatives of the European Union and Japan met to discuss Customs matters related to the EU-Japan Economic Partnership Agreement. It was the ninth meeting of the “Joint Customs Cooperation Committee” and the first meeting of the “Committee on Rules of Origin and Customs Related Matters”.

Background Information

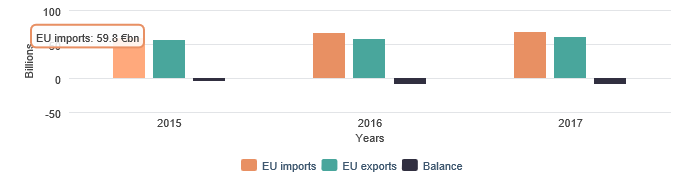

Japan is the EU’s second-biggest trading partner in Asia after China.