The AEO concept is based on the Customs-to-Business partnership introduced by the World Customs Organisation (WCO).

Traders who voluntarily meet a range of criteria work in close cooperation with customs authorities to assure the common objective of supply chain security are entitled to enjoy benefits throughout the EU.

This implies that there must always be a relationship between customs and the applicant/AEO. This relationship must be based on the principles of mutual transparency, correctness, fairness and responsibility.

A legal basis for the EU AEO programme was provided in 2008 through the 'security amendments' to the "Community Customs Code" (CCC) (Regulation (EC) 648/2005) and its implementing provisions.

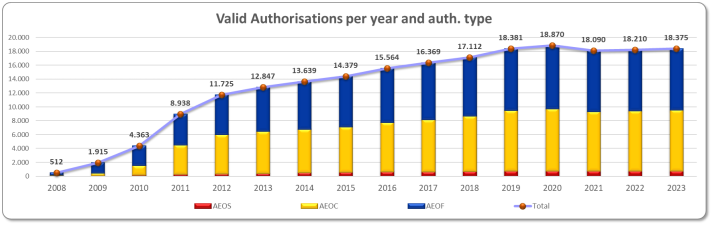

The programme, which aims to enhance international supply chain security and to facilitate legitimate trade, is open to all supply chain actors. It covers economic operators authorised for customs simplification (AEOC), security and safety (AEOS) or a combination of the two.

Who can become an AEO?

Any economic operator established in the customs territory of the Union who is part of the international supply chain and is involved in customs-related operations, may apply for the AEO status.

On the basis of Article 39 of the Union Customs Code (UCC), the AEO status can be granted to any economic operator meeting the following common criteria:

| Conditions and criteria | AEOC | AEOS |

|---|---|---|

| Compliance with customs legislation and taxation rules and absence of criminal offences related to the economic activity | X | X |

| Appropriate record keeping | X | X |

| Financial solvency | X | X |

| Proven practical standards of competence or professional qualifications. | X | |

| Appropriate security and safety measure | X |

The AEO status granted by one Member State is recognised by the customs authorities in all Member States.

AEO Benefits

AEO benefits are an integral part of the EU legislation governing the AEO status. The AEO benefits, dependant on the type of the authorisation, are summarised in the table:

| Benefit | AEOC | AEOS |

|---|---|---|

| Easier admittance to customs simplifications | X | |

Fewer physical and document-based controls

| X | X |

| Prior notification in case of selection for physical control (related to safety and security) | X | |

| Prior notification in case of selection for customs control (related to other customs legislation) | X | |

| Priority treatment if selected for control | X | X |

| Possibility to request a specific place for customs controls | X | X |

| Indirect benefits (recognition as a secure and safe business partner; improved relations with customs and other government authorities; reduced theft and losses; fewer delayed shipments; improved planning, customer service and customer loyalty; lower inspection costs of suppliers; increased co-operation etc.) | X | X |

| Mutual Recognition with third countries | X |

Where to apply for AEO status?

The Member State to which the AEO application must be submitted is determined by the EU legislation.

The competent customs authority shall be that of the place where the applicant’s main accounts for customs purposes are held or accessible, and where at least part of the activities to be covered by the decision are carried out.

Whenever it is not possible, based on the above mentioned general principle, to clearly determine which Member State should act as “competent customs authority” the competent customs authority shall be:

- that of the place where the applicant's record and documentation enabling the customs authority to take a decision (main accounts for customs purposes) are held or accessible (e.g. the place where the administrative headquarter of the applicant company is located), or

- that where the applicant has a permanent business establishment and where the information about its general logistical management activities in the Union is kept or is accessible as indicated in the application.

As such, the Member State where to submit an application to obtain the AEO status is not a choice of the trader.

If the application is submitted to a “non-competent” customs authority the application cannot be accepted by that office.

A trader (holder of an EORI number) can be the holder of only one AEO status (meaning one authorisation per EORI) in the EU.

Therefore, there is only one Competent Customs Authority per trader in the EU.

The AEO status (authorisation) granted by the Competent Customs Authority is recognised by Customs Authorities in all Member States. The AEO authorisation is, therefore, an EU authorisation.

How to apply?

The data elements to be included in the AEO application are established by the EU legislation.

As of 1 October 2019 the submission of AEO applications has to be made electronically through the EU Trader Portal.

Accessing the EU Trader Portal

For France, Germany and Spain access happens through these countries’ respective National Trader Portal which can be accessed through the links in the table.

Economic operators need to have an EORI number and the appropriate roles assigned to access the system.

In order to obtain an EORI number and role, economic operators need to contact the competent authority for EORI registration.

Traders applying for an AEO status in a Member State using the EU trader Portal for eAEO must select the “receiving customs authority” (RCA) by respecting the legal rules mentioned in under the heading “Where to apply”.

The application can be made either by the EO or by his/her representation after giving the appropriate delegation.

The access to the EU Trader Portal for eAEO is protected by the Uniform User Management and Digital Signature System (UUM&DS).

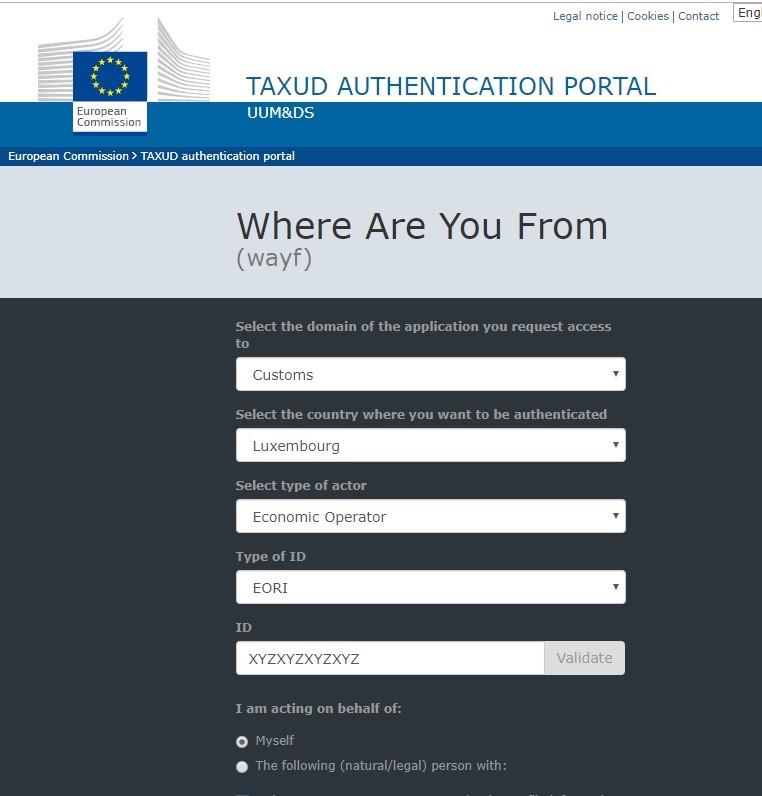

UUMDS Authentication system for the EU Trader Portal for eAEO

The access to the EU Trader Portal for eAEO is protected by the Uniform User Management and Digital Signature System (UUM&DS).

Before using any of the systems secured by UUM&DS, the users should identify themselves (authenticate).

The EO (or delegatee) accesses the EU Trader Portal using this link.

There are different procedures for authentication depending on whether the authentication happens with or without delegation.

Authentification without delegation

On the WAYF page, provide the following information:

- The Domain (Customs)

- The Member State where you want to be authenticated (the Member State of the Economic Operator as registered in his/her EORI information)

- Type of Actor (Economic Operator)

- Type of ID (optional, depending of the chosen Member State)

- ID (optional, depending of the chosen Member State). The “Validate button” performs a direct validation of an EORI number in the European Commission’s EORI database

The list of possible “Types of Actor” and “Type of ID” may vary depending on the delegation authorised and the supported “Types of Actors” for the country where you want to be authenticated.

Note that the same process also applies for first level delegation employees by selecting ‘Employee’ instead of ‘Customs Representatives’ in the dropdown.

Tick the box giving consent to share the user's Identity Profile with UUM&DS and then click Submit.

You will be then redirected to the Authentication System where you will perform the actual authentication.

Once authenticated, you will be redirected to the eAEO Trader Portal or to a UUM&DS error page if the access is denied.

Authentification with delegation

There are different procedures to authenticate with delegation, depending on the EU Member State to which the application is made.

- For Cyprus, Germany, Greece, Ireland, Luxemburg, Romania, Slovakia this document describes the basic nominal work flow for delegation creation and approval.

- For the other EU Member States, the Economic Operators should contact their National Customs Administration for more information.

Logging out

In order to logout from UUM&DS, the most reliable option is to close the browser, this not only closes the session with UUM&DS but also with the Authentication System.

The Self Assessment Questionnaire (SAQ)

The SAQ must be filled in and signed by the applicant economic operator and not by his/her representative, if any.

Each Member State publishes its own template of the SAQ.

AEO Logo

Holders of a valid AEO authorisation can use the logo. It is important to note that the AEO logo is copyrighted and the rights belong to the European Union.

The AEO Logo is provided to AEOs by their competent customs authorities.

The EO must stop using it as soon as its AEO status is suspended or revoked and any abuse will be pursued according to EU law.